full

Financial Literacy for Teens and Kids with Clifton Corbin

Money is such a difficult conversation to have with anyone. However, it's a vital part of living in today's world. That's why it's time to talk about money, especially with your children. Learning how to manage money and becoming financially literate is a life skill everyone needs to develop. As parents, it's up to you to have these conversations and ensure you know how to teach financial literacy for teens and kids.

Here to talk about money in this episode is Clifton Corbin, an advocate for financial literacy. He shares his passion for educating yourself and your children about money. He also talks about why it's essential to have these difficult discussions.

Talking about money isn't something to be scared of. Instead, Clifton invites you to start the conversation and learn about finances.

3 Reasons to Listen:

- Understand why financial illiteracy is happening and what you can do to change that.

- Learn why it’s important to teach financial literacy for teens and kids to your children.

- Hear concrete tips and advice from Corbin about how you can start helping your children become financially literate.

Resources

Clifton Corbin:

Your Kids Their Money by Clifton Corbin

Richest Man in Babylon: Revised for Modern Times by George S. Clason, Edited by Clifton Corbin and Kaleb Corbin

About Clifton

Clifton Corbin is a financial literacy advocate, author, and speaker. He is also a registered financial consultant and has a Master's Degree in Business Administration. Clifton is passionate about advocating for financial literacy among children, young adults, and parents. Using his experience managing million-dollar budgets, and understanding of economics and personal, finance, he teaches children and parents the importance of financial literacy for teens and kids.

Clifton is also a stay-at-home dad! He, himself, is having conversations with his kids about money. His book, Your Kids, Their Money, guides parents in teaching their children to be financially literate. He also revised The Richest Man in Babylon and related it to personal finances in today’s society.

Learn more about Clifton’s work on his website.

Episode Highlights

[02:41] The Many Things Clifton Does

- Clifton is an advocate for financial literacy. He’s passionate about helping spread financial literacy for teens and kids.

- He is also a stay-at-home dad. Even at home, Clifton can find creative ways to maximize his time even without a full-time job.

- Too often, people tie their identities to their job. Before leaving his office job, he trained for a managerial position.

- Leaving meant losing opportunities. Clifton wouldn’t be able to teach younger talent and wouldn’t be able to be a voice in the diversity of different roles as a black male.

- It was hard for him at the beginning. However, he still found many opportunities to give back and support the communities he is a part of.

[06:29] The Many Roles of One Person

- Clifton loves to learn and create. However, he never sought to be an author. He had something to share, so he wrote a book.

- He enjoys working on different things but doesn't necessarily identify with each of them.

- Clifton is a husband, a father, a friend, and many more. It takes a lot of work to compress a person into one title.

- Rather than ask a child what they want to be when they grow up, it can be better to ask them what they want to do for the next few years.

- What you want to do can change. Even as adults, people are still figuring out who they are.

[13:26] The Financially Illiterate Epidemic

- Too many people see talking about money as taboo. Not enough schools teach financial literacy for teens and kids either.

- It can be an incredibly complicated and individualized topic. Educating yourself about finances requires time and effort to figure out how it works.

- It's essential to encourage people to talk about money. It can be hard to have this conversation because many are afraid of it.

- Having more conversations about money can lead to an exponential increase in financial literacy. People need to talk about money to learn.

- Financial literacy for teens and kids is essential for them to have a secure future.

[16:19] “If we can open up some of these conversations. If we can have some more transparency with regard to our money. I think what will happen is the financial literacy will increase exponentially.” - Click Here To Tweet This

[18:02] The Life Skill of Making Money

- As taught in school, financial literacy for teens and kids doesn't prepare them. The concepts are too general.

- You're still responsible for educating your child. It's not just about teaching your child how to manage money but also about values and principles.

- Financial literacy is a life skill. Children need to learn how to manage money and how to feel confident and comfortable with doing so.

- Without teaching them, children may never learn these skills or learn them the hard way.

- People need to build these habits and skills to be ready for when they need to use them.

[20:32] “One of the skills they (our children) will absolutely need is how to manage money, how to feel confident, and comfortable managing money in a way that will benefit them.” - Click Here To Tweet This

[23:29] The Importance of Financial Literacy for Teens and Kids

- From an early age, Clifton's parents were open with him about money. However, he only learned about earning money and saving it.

- With only those two aspects, he had fractured financial literacy. He lacked deeper knowledge about managing money and ended up making mistakes.

- In making and fixing those mistakes, he learned about all the other aspects of financial literacy.

- Clifton wants to ensure that the youth can get the whole picture of financial literacy early on. Learning these things can help prepare them for the future.

- Wherever you are in you're life, you want to feel like you can manage your money. It's about knowing what to do and feeling confident and comfortable doing so.

[29:49] Teaching Financial Literacy for Teens and Kids as a Parent

- No matter your confidence in your knowledge, parents automatically know more about money than their children do.

- However, you can also take this opportunity to educate yourself and learn more about what you don’t know.

- Share with your children what you know, like personal experiences that taught you firsthand.

- If you choose not to talk about it, you're not informing or educating your children. You have to teach them how the world works; money is a big part.

[30:46] “If you don't feel like you've got your money under control, this is the chance to say, ‘Okay, I'm going to start learning.’“ - Click Here To Tweet This

[34:40] Money in Many Cultures

- Different cultures might teach and approach money differently. But regardless of culture, having these conversations, especially with your children, is vital.

- Generational gaps, gender, age, and even familial structure can affect how these conversations go.

- You have the advantage in conversations with your children because they don’t yet have these different stigmas about money.

- Show your children that you are open to discussion. Let them ask questions and encourage honest communication to build relationships and trust.

- Run toward conversations that make you uncomfortable. Often, it’s these conversations that promote your growth as a person.

[38:43] "Run towards the conversations that make you feel uncomfortable. If you can have those conversations, things get better." - Click Here To Tweet This

[39:48] Your Kids, Their Money

- Clifton's book, Your Kids, Their Money is a guide for parents, guardians, and adults, in general, to hold conversations about money.

- The title encapsulates the need to support kids and teach them to be responsible with their money.

- The book also provides a peek into Clifton's life. He talks about the importance of managing money and appreciating community.

- It’s written for parents to help them start having these conversations. The book includes resources and advice on what you need to know and what you can say to your kid.

- It’s never too late or too early to start teaching your kids about money.

[45:09] Getting The Conversation Started

- Give your children an opportunity to practice their financial skills through a budget or allowance. Letting them handle money can go a long way to learning how to manage money.

- Making financial conversations a natural part of your life is also helpful.

- Having both these conversations and opportunities to practice can help them develop a better mindset about money.

- For younger children, focus on teaching them about finances. Be an advisor to older children to help deepen their understanding through discussions and questions.

- Clifton advises against tying allowance to work. What's important is that your children can practice using money.

[47:14] “Have those conversations and just make them part of your everyday. So that your kids are just in the mindset of thinking about what they could be doing and what they should be doing.” - Click Here To Tweet This

[56:43] Clifton on Teaching Financial Literacy for Teens and Kids

- Clifton's oldest child is 10, and the youngest is 8.

- Both his kids get an allowance. His son is money-motivated, but his daughter is less so. Each individual has their own approach to managing money.

- However, both are motivated by donating and helping the less fortunate. Just recently, his son gave some of his money to someone asking for loose change.

- Clifton is glad to be able to give them these kinds of opportunities to express themselves.

[56:13] Doubling Down on Creating

- Right now, Clifton is in a creative mindset. He is working on a workbook version of his book and a tabletop game about personal finances.

- In the past, he has focused a lot on the administrative side of his advocacy. Now, he wants to focus on creating.

- It’s energizing for Clifton to create.

Enjoy the Podcast?

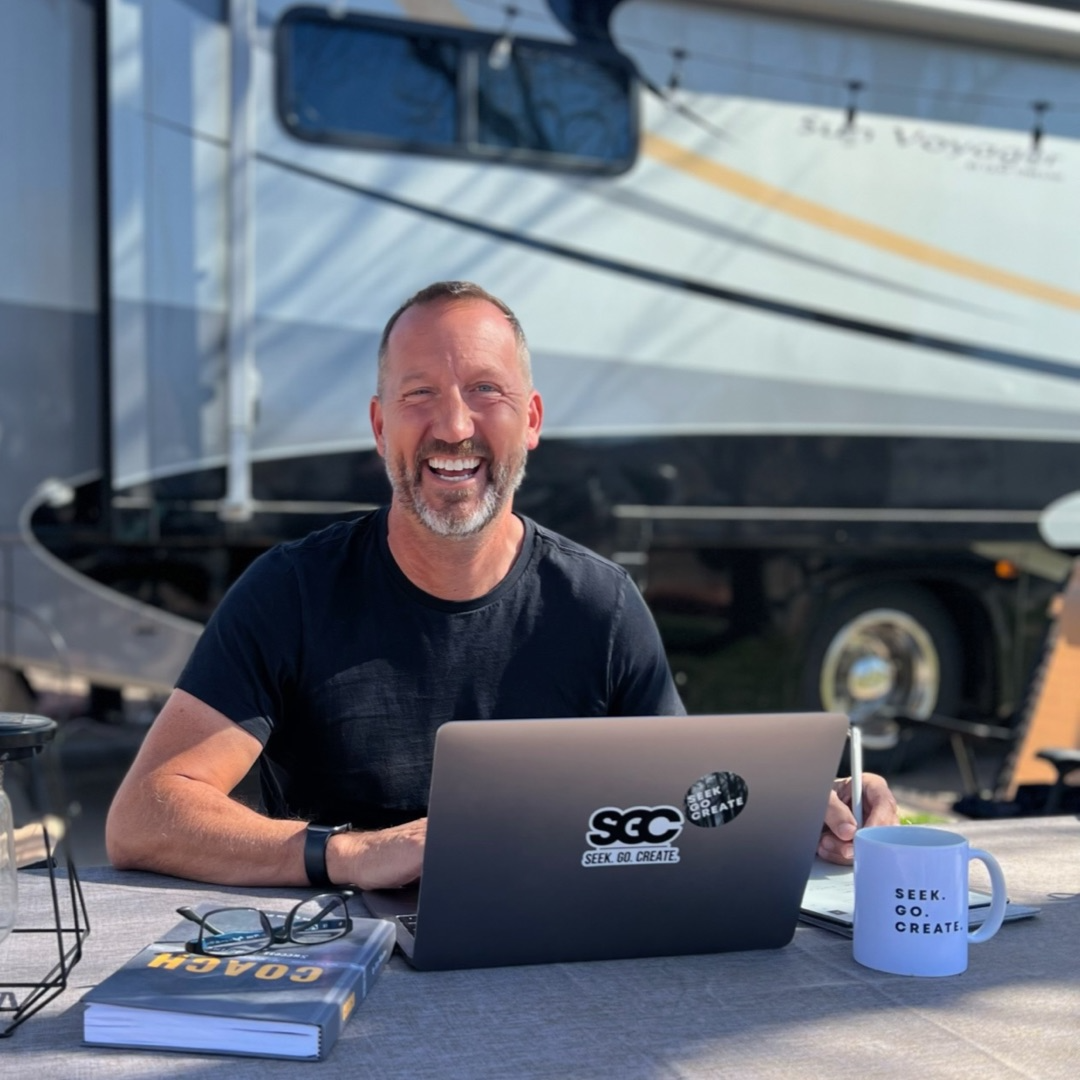

Seek Go Create is for anyone seeking excellence, moving towards success, or creating something new. We share topics, stories, and conversations that allow us to rethink how we live, work, and lead. Financial literacy for teens and kids is a critical skill. It’s our responsibility as parents to teach our children.

If you were inspired and educated by this episode, feel free to subscribe to us on Google Podcasts, Apple Podcasts, or Spotify so that you never miss another episode. Also, share this episode or what you’ve learned today on your favorite social media platform.

Love to give us 5 stars? If you do, we’d love a review from you. By doing this, you can help us reach more people who want to redefine success in their lives.

Connect with the SeekGoCreate Network! For updates and more episodes, visit our website or follow us on Facebook, Instagram, LinkedIn, Twitter, and YouTube.

To growing and becoming all we are created to be,

Tim

Mentioned in this episode:

Stop Reacting, Start Leading: Free 30-Minute Coaching Call

Are you leading with strategy or just reacting to the daily chaos? If you're feeling stuck, constantly putting out fires, and struggling to focus on the big picture, it’s time to take control. I’m offering a FREE 30-minute coaching call to help you shift from reactive to proactive leadership with clear, actionable strategies. Whether you’re facing new challenges or just need a reset, this call will give you clarity and direction. Book your free coaching call now by clicking the link in the show notes or visiting TimWinders.com/coaching.