full

From Chaos to Calm: Kendra Nicole's Financial Wisdom for Entrepreneurs

Are you an entrepreneur who's ever felt the burden of financial chaos on your shoulders? In this captivating episode of Seek Go Create, we sit down with financial guru Kendra Nicole, CEO of Finance Femme, who unpacks the essentials of balancing "peace and profits" in the business world. From the pitfalls of poor financial data to the transformative power of professional financial management, we dive deep into the strategies that empower women entrepreneurs to thrive without compromising personal wellness. Get ready for an insightful conversation that challenges traditional notions of success and uncovers the keys to sustainable business growth. Tune in to learn how to turn financial confusion into clarity and confidence!

"Peace and profits are not mutually exclusive; they are the dual pillars of sustainable entrepreneurship" - Kimberly Nicole

Access all show and episode resources HERE

About Our Guest:

Kendra Nicole is the CEO of Finance Femme, a virtual CFO and accounting firm dedicated to empowering women entrepreneurs to build sustainable and thriving businesses. With a profound understanding of the impact of financial data, Kendra is committed to enhancing informed decision-making for her clients. Her calmness amidst chaos is her superpower, helping her navigate the complex challenges faced by female entrepreneurs in the corporate landscape. Kendra’s focus on fostering a balanced approach to profitability and personal welfare makes her not only a financial strategist but also a valued partner to the women she serves, helping them to achieve peace alongside their business profits. With her background in corporate finance, Kendra carries significant experience in understanding the dynamics between financial officers and CEOs, translating it into a business model that supports strong financial management for growing enterprises.

Reasons to Listen:

1. Discover How Quality Financial Data Transforms Business: Uncover why Kendra Nicole believes accurate financial reporting is vital for informed decision-making and how it can empower sustainable entrepreneurship without sacrificing personal well-being.

2. Insights into Female Entrepreneurship: Explore the unique challenges women business owners face, as Kendra Nicole shares her journey to supporting female leaders and the importance of fostering support and candid conversations in the workplace.

3. Mastering Financial Strategy with Expertise: Gain clarity on the specific roles of financial professionals in your business, learn when to hire them, and understand the intricate balance of "peace and profits" with advice from a seasoned virtual CFO.

Episode Resources & Action Steps:

### Resources Mentioned:

1. **Website**: Finance Femme (www.financefem.com) - The website where listeners can learn more about the services Kendra Nicole offers, such as executive accounting solutions, fractional CFO services, and tax handling.

2. **Email**: info@thefinancefem.com - Listeners can directly contact Kendra Nicole or her team for consultations or inquiries about their financial planning and business strategy needs.

### Action Steps:

1. **Evaluate Financial Data**: Listeners should review their business’s financial data to assess accuracy and quality. Understanding the significance of reliable data can guide better decision making for the future of the business.

2. **Consider Professional Financial Help**: Business owners, especially those at particular revenue milestones, should consider hiring a bookkeeper, accountant, or even a fractional CFO, to manage their financial matters, which can ultimately lead to both peace and profitability.

3. **Self-Reflect on Business Goals**: Encouraging listeners to reflect on their 'why' behind their entrepreneurial endeavors. This could lead to improved alignment with their values and attracting clients or customers who respect those same principles.

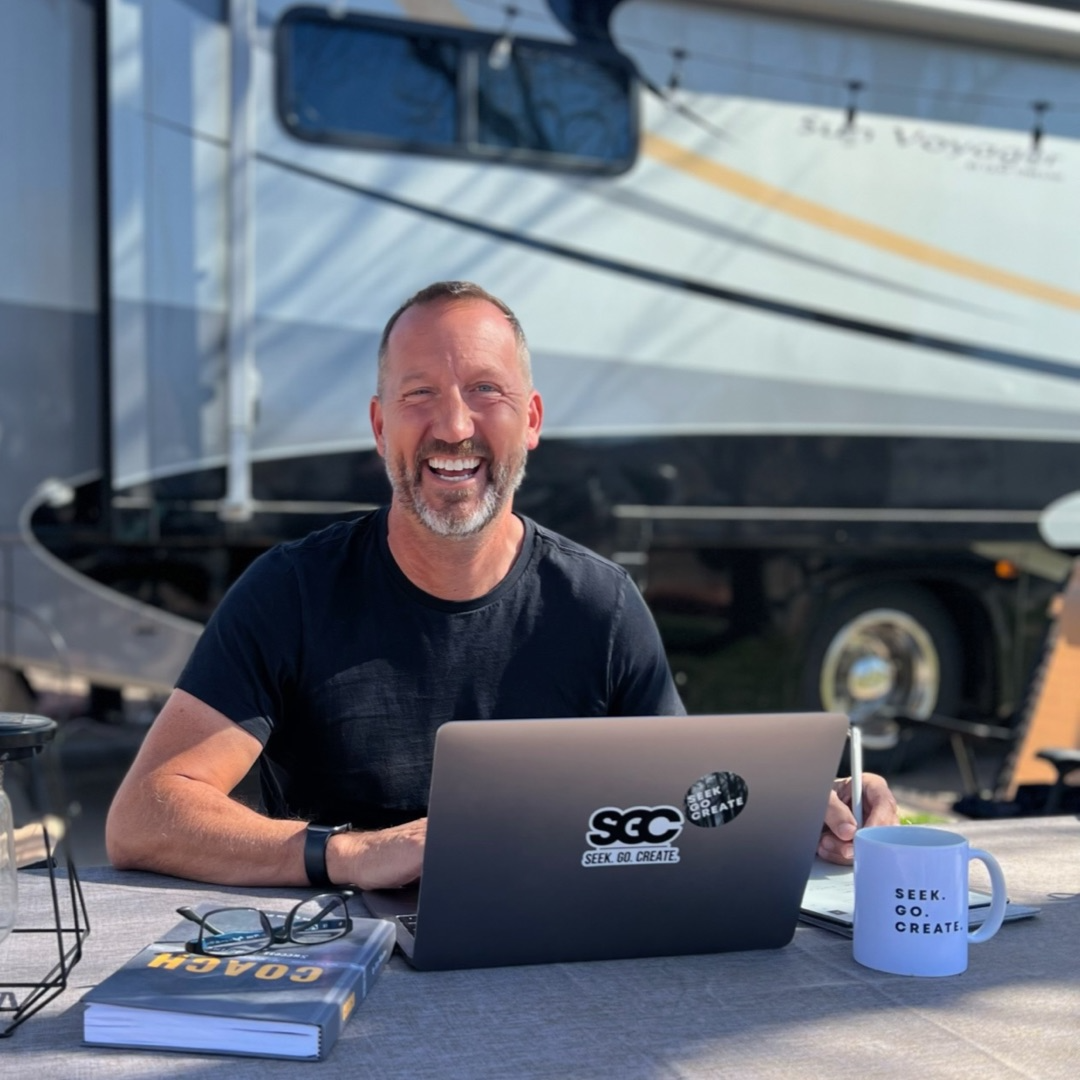

Resources for Leaders from Tim Winders & SGC:

🔹 Unlock Your Potential Today!

- 🎙 Coaching with Tim: Elevate your leadership and align your work with your faith. Learn More

- 📚 "Coach: A Story of Success Redefined": A transformative read that will challenge your views on success. Grab Your Copy

- 📝 Faith Driven Leader Quiz: Discover how well you're aligning faith and work with our quick quiz. Take the Quiz

Key Lessons:

1. **Balance Peace with Profit**: It's vital to manage your business in a way that ensures profitability while also maintaining your personal peace and well-being. Kendra Nicole emphasizes the importance of not only focusing on the financial aspect but also integrating a balanced lifestyle, especially for women who juggle entrepreneurship with roles like motherhood.

2. **Seek Professional Financial Help When Necessary**: Business owners, particularly women, often feel they need to handle every element of their business, but Kendra advises that hiring professionals like bookkeepers, accountants, or CFOs can offer numerous benefits. Delegating financial tasks to experts can provide clearer insights, allow for better decision-making, and ultimately lead to growth and stability for the enterprise.

3. **The Importance of Understanding Financial Data**: Accurate and quality financial data is indispensable for making informed business decisions. Kendra Nicole illustrates the negative consequences of bad financial data and stresses the significance of using precise data to drive your business strategy.

4. **Know When to Hire Financial Experts**: Kendra outlines when it's appropriate for a business to consider hiring financial professionals. She suggests businesses making around $100,000 in sales should look into hiring a bookkeeper, while companies with revenue of $250,000-500,000 or those undergoing significant changes should contemplate a fractional CFO.

5. **Align with Values and Goals in Client Relationships**: Tim Winders and Kendra Nicole discuss the need for alignment between a business's values and those of its clients. Kendra shares how understanding her clients' "why" behind their ambitions has improved working relationships and allowed her to attract clients that resonate with her firm's focus on "peace and profits."

Episode Highlights:

00:00 Mom, wife, business owner, virtual CFO advocate.

06:03 Challenges for female entrepreneurs discussed by older man.

07:02 Woman entrepreneur focused due to corporate experiences.

12:38 Regret about moving jobs, affected by family's opinion.

14:37 Corporate learning: Relationships key to career success.

18:04 The complexity of portraying business success accurately.

20:47 Money brings happiness when shared with others.

23:23 Discussing mindset and money management in business.

28:21 Overused optimism can be a weakness.

30:20 Consider end goal before taking financial risk.

33:59 Bookkeeper, accountant provide historical data; CFO is forward-looking.

39:46 Agreeing with outsourcing tasks vs. doing them.

42:09 Balancing alarm with the reality of data.

46:03 Transitioning mindset to profit with purposeful peace.

50:28 Rejecting clients seeking quick profit-driven success.

54:13 Focus on key numbers that matter to business.

54:56 Track, analyze, and be confident with numbers.

59:00 Seek understanding your why in business endeavors.

Thank you for listening to Seek Go Create!

Our podcast is dedicated to empowering Christian leaders, entrepreneurs, and individuals looking to redefine success in their personal and professional lives. Through in-depth interviews, personal anecdotes, and expert advice, we offer valuable insights and actionable strategies for achieving your goals and living a life of purpose and fulfillment.

If you enjoyed this episode and found it helpful, we encourage you to subscribe to or follow Seek Go Create on your favorite podcast platform, including Google Podcasts, Apple Podcasts, and Spotify. By subscribing, you'll never miss an episode and can stay up-to-date on the latest insights and strategies for success.

Additionally, please share this episode or what you’ve learned today with your friends, family, and colleagues on your favorite social media platform. By sharing our podcast, you can help us reach more people who are looking to align their faith with their work and lead with purpose.

For more updates and episodes, visit our website or follow us on Facebook, Instagram, LinkedIn, Twitter, TikTok and YouTube. We appreciate your support and look forward to helping you achieve your goals and create a life of purpose and fulfillment.

Now, you can tip us, buy us a coffee, or offer financial support. Contributions start at just $1, and if you leave a comment, you could be featured in a future episode!

Visit our Support page for more details.

Mentioned in this episode:

Unleash Your True Leadership Potential with Tim Winders

Imagine embracing the full extent of the leadership potential you were created to fulfill. This isn't just a dream; it's a journey that begins today with Tim Winders, your mentor in transformative leadership. Through Tim's executive coaching, you'll dive into the core of what it means to be a truly influential leader – one who combines skill with vision and unwavering faith. It's about transcending conventional success, embracing your purpose, and discovering the joy in leading. If you feel called to become the leader you were always meant to be, book your free Discovery Coaching Call with Tim. This is where your transformative journey to authentic and purpose-driven leadership begins. Let's unlock the extraordinary leader within you.

Transcript

Bad financial data hurts you every single day in your

Kendra Nicole:business, because especially if you're using that data to make decisions,

Kendra Nicole:garbage in, garbage out, right?

Kendra Nicole:So if I'm trying to determine how I'm going to scale my business

Kendra Nicole:based on garbage data, I'm not going to scale my business properly.

Kendra Nicole:You

Tim Winders:What if you could redefine the grind of entrepreneurship into

Tim Winders:a journey of Peace and profits.

Tim Winders:Welcome to Seek, Go Create where today's guest, Kendra Nicole, shares

Tim Winders:her revolutionary approach to business.

Tim Winders:As a fractional CFO, Kendra has transitioned from running her

Tim Winders:successful accounting firm to empowering entrepreneurs to build

Tim Winders:sustainable, scalable businesses without sacrificing their wellbeing.

Tim Winders:Balancing her roles as a CEO, wife, mother, Kendra embodies the principles

Tim Winders:she teaches, proving that it's possible to achieve financial success

Tim Winders:alongside personal fulfillment.

Tim Winders:welcome to Seek Go Create.

Kendra Nicole:Thank you.

Kendra Nicole:Thank you.

Kendra Nicole:I appreciate it.

Kendra Nicole:I love being here.

Tim Winders:I'm glad you're here too.

Tim Winders:Kendra, Nicole, welcome.

Tim Winders:Let's do this first before we start.

Tim Winders:If, if somebody bumps into you, you run into somebody, you're traveling,

Tim Winders:you're out with, you're out with your child, something like that.

Tim Winders:And they say, what do you do?

Tim Winders:What do you tell people?

Kendra Nicole:Yeah, I tell them I'm a little bit of a superhero.

Kendra Nicole:Honestly, I'm a wife.

Kendra Nicole:I'm a mom.

Kendra Nicole:so it's hodler at that.

Kendra Nicole:I, run a business called the finance film, which is a

Kendra Nicole:virtual CFO and accounting firm.

Kendra Nicole:exclusively support women on entrepreneur or women entrepreneurs,

Kendra Nicole:and do all the things from a book, bookkeeping, financial reporting,

Kendra Nicole:investor relations, fractional CFO work.

Kendra Nicole:And yeah, so I've been, we, I run that business my day to day and

Kendra Nicole:I, I try to run the household a little bit as best as I can as well.

Kendra Nicole:And, do all the, all the things,

Tim Winders:so superheroes, you mentioned that word.

Tim Winders:So I'm going to ask this question.

Tim Winders:Superheroes usually have some type of a superpower.

Tim Winders:And it's something that sort of defines them.

Tim Winders:What's weird is, in these Marvel and DC universes, usually there was some kind

Tim Winders:of accident that occurred that brought out their, their, their superpower.

Tim Winders:But, what, what are your superpowers?

Kendra Nicole:I feel like I have grown over the years to have the

Kendra Nicole:ability to stay calm and chaos, which was not always the case.

Kendra Nicole:if there was a tornado going around me, I was going around in the tornado with it.

Kendra Nicole:But, over the last few years, probably three, four years or so,

Kendra Nicole:which my son is three and a half.

Kendra Nicole:So yeah, I'll say about three years, I have learned to, how to find

Kendra Nicole:calm in the chaos, which I do feel like is a superpower these days.

Tim Winders:Probably not anything that you master though, or we have,

Tim Winders:we have a four year old and a two year old granddaughters, grandchildren.

Tim Winders:And we talked to our daughter and, we've parented, but we're, we're beyond it.

Tim Winders:We're done with that.

Tim Winders:It seems like it's extremely tough in the world and culture we're in today.

Tim Winders:I don't know if it's different or whatever.

Tim Winders:I mean, it seems like there's always something going on, right?

Kendra Nicole:Absolutely.

Kendra Nicole:And, and four and two.

Kendra Nicole:so that means that your grandbabies came into the world around the time

Kendra Nicole:that Carter did with pandemic and all of that, that was going on as well.

Kendra Nicole:And it's just different.

Kendra Nicole:Of course, Carter's my first child, so I don't know how, how it is having a child

Kendra Nicole:outside of a pandemic, but I do know that.

Kendra Nicole:it's just been a really rough welcoming to motherhood, when you can't have

Kendra Nicole:friends and family over to travel to see you and, so it was definitely hard.

Kendra Nicole:And yes, you're right.

Kendra Nicole:There's no mastering the calm in chaos.

Kendra Nicole:There's kind of just, taking it day by day and trying to grasp onto it.

Kendra Nicole:As much as you can.

Kendra Nicole:And sometimes it will slip through your fingers and you will be amongst the

Kendra Nicole:chaos, but it's as much as you can.

Kendra Nicole:I'm holding on to that calm and knowing that, this too shall pass with everything.

Kendra Nicole:This too shall pass.

Tim Winders:Yeah, that's interesting.

Tim Winders:I forgot that our, our oldest granddaughter was

Tim Winders:born like February of 2020.

Tim Winders:So it sounds like, you were

Tim Winders:short later that year.

Tim Winders:and and it was real odd.

Tim Winders:We were in Colorado when she was born and we were around there and we, we

Tim Winders:weren't supposed to visit, but we did anyway, it's hard to not do that.

Tim Winders:But I do believe like for her first six months or something,

Tim Winders:I don't know that she left.

Tim Winders:I mean, I don't know, they couldn't go to church.

Tim Winders:They couldn't go out.

Tim Winders:Anywhere.

Tim Winders:And I think we talked about it.

Tim Winders:What, what kind of impact is that going to have on that group of,

Tim Winders:of children, that didn't get out, but you know, she seems okay.

Tim Winders:did you say what's, what's his name?

Tim Winders:Carter.

Tim Winders:Wait, what's the name?

Kendra Nicole:Carter.

Tim Winders:How, I mean,

Tim Winders:adjusting.

Tim Winders:I mean, kids adjust well though, don't they?

Kendra Nicole:Yeah, my dad always told me, children are very

Kendra Nicole:resilient and I see it all the time.

Kendra Nicole:And, he's this life has definitely put that to the test where I'm able to

Kendra Nicole:see it day in and day out that they're very resilient because I was worried,

Kendra Nicole:his first year of life because to your point, he was born in September 2020.

Kendra Nicole:So his first year of life, everyone's talking with a mask.

Kendra Nicole:So we're like, how is he going to learn how to speak in phonetics?

Kendra Nicole:And everyone's mouth is covered.

Kendra Nicole:And my dad is like, kids are resilient.

Kendra Nicole:Don't worry.

Kendra Nicole:He'll be fine, so yeah, I mean, from what I can tell, everything seems seems

Kendra Nicole:fine, but I do believe there's going to be like a docuseries on, new moms

Kendra Nicole:during the pandemic, like there has to be something that's going to come out at some

Tim Winders:I think the kids are resilient.

Tim Winders:I'm not sure if the parents and the adults are, we're

Tim Winders:thinking about all these things.

Tim Winders:Yeah, I can kind of see it 20 years from now.

Tim Winders:It's like the, the, the COVID, the pandemic generation, they were

Tim Winders:born during that 12 to 24 months.

Tim Winders:how are they doing now?

Tim Winders:And I I think they're, Going to be just fine, but that does bring

Tim Winders:up something that it, it seems as if you have narrowed down with how

Tim Winders:you work and who you work with.

Tim Winders:And that is female entrepreneurs, which are going through

Tim Winders:what you're talking about.

Tim Winders:And, I, I, I do want to say this.

Tim Winders:There's, there's some irony in, a guy, first of all, an older, mature

Tim Winders:guy, like me asking these questions.

Tim Winders:It's just different though.

Tim Winders:And I mean, I think if we can't say it's different, then we're

Tim Winders:kind of fooling ourselves.

Tim Winders:Guys, men are going through different.

Tim Winders:Stuff than the women, female entrepreneurs, leaders

Tim Winders:that you're working with.

Tim Winders:So just kind of big picture, kind of talk about what are some of those challenges?

Tim Winders:We probably have already addressed some, but what are some of those that that those

Tim Winders:leaders are dealing with, especially the female leaders that you interact with?

Tim Winders:Sure.

Kendra Nicole:Yeah.

Kendra Nicole:And I appreciate you, you saying that.

Kendra Nicole:so when I started and wanted to really focus on women

Kendra Nicole:entrepreneurs, it was because.

Kendra Nicole:I was coming out of corporate where I was, I actually had a lot of male

Kendra Nicole:bosses and they were all excellent.

Kendra Nicole:I've loved every single boss that I had in corporate.

Kendra Nicole:but I would see some of the leaders, the company I was working for at the time,

Kendra Nicole:the CFO was actually a woman and, she was, privately having these conversations with

Kendra Nicole:some of us, like female colleagues about like how hard it was with her children.

Kendra Nicole:Her children were really young and, she would kind of give us these lessons

Kendra Nicole:when you do have children, think about this and think about that and kind

Kendra Nicole:of like coaching us a little bit, but it was like these side conversations.

Kendra Nicole:and so that kind of struck something in me that, okay, women, we need support.

Kendra Nicole:Like we should be able to Not just have these conversations with their colleagues,

Kendra Nicole:but have them openly and understand that, yes, there are things that we have to kind

Kendra Nicole:of deal with even, even if the household is, split 50 50, which can it ever be.

Kendra Nicole:But even if it's kind of well managed, there's still just things

Kendra Nicole:physically that you take on when you are either going through having

Kendra Nicole:children or emotionally, hormonally.

Kendra Nicole:so that's really why I wanted to focus in on supporting women when

Kendra Nicole:it came to, kind of birthing their entrepreneurial journey as well.

Tim Winders:And, and, and listen, I want to say, I'm a man, I've been through

Tim Winders:all of that, my best bosses, leaders that I interacted with way back when I

Tim Winders:did corporate, they were all females.

Tim Winders:And, and also want to say that on the flip side of all the things you just mentioned,

Tim Winders:us men, we don't really know what to do.

Tim Winders:We, we.

Tim Winders:Couldn't handle all of those superpowers.

Tim Winders:We're just not equipped to do it.

Tim Winders:And also want to say this, it's probably not fair.

Tim Winders:It is probably not a fair structure and system.

Tim Winders:My wife would probably chime in and say, yeah, it's not, but.

Tim Winders:But it is what it is.

Tim Winders:And you've been through, so you've had, you've had like, transitions

Tim Winders:and shifts in your career.

Tim Winders:And, are you originally from the South Clemson university?

Tim Winders:Where, where are you originally from before you went to Clemson?

Kendra Nicole:I did.

Kendra Nicole:I lived in South Carolina for a little while.

Kendra Nicole:So I went to high school in South Carolina and, fell in love with Clemson.

Kendra Nicole:And so that's why I ended up going, going there for school, but definitely

Kendra Nicole:have had several, transitions.

Kendra Nicole:I would say the largest were, was, obviously, just

Kendra Nicole:going into corporate, right?

Kendra Nicole:Like real life, going from college to corporate and then

Kendra Nicole:climbing that corporate ladder.

Kendra Nicole:my goal was always to stay in corporate.

Kendra Nicole:I knew nothing about entrepreneurship.

Kendra Nicole:Like I do not have an entrepreneurship family.

Kendra Nicole:I'm definitely a corporate climbing family.

Kendra Nicole:so when I started into entrepreneurship, that transition was very new

Kendra Nicole:and very different for me.

Kendra Nicole:And that was probably the biggest one.

Kendra Nicole:like the first one that I, that I kind of took.

Tim Winders:So what was, when, when you entered that corporate world and we're

Tim Winders:going to tie some of this together as it leads into what you're doing now, but

Tim Winders:when you entered that corporate world, you mentioned climbing the ladder,

Tim Winders:but what How did you define success?

Tim Winders:One of the things we do here is we talk a lot about success and how we

Tim Winders:define it and how it changes over time.

Tim Winders:But when, coming out of college, going into corporate, what was your definition

Tim Winders:of success then, if you can recall?

Kendra Nicole:Yeah.

Kendra Nicole:So my dad had a big part in that.

Kendra Nicole:He actually worked at Toyota for over 30 years and was like way

Kendra Nicole:up there, one of the high execs.

Kendra Nicole:And so I always saw that.

Kendra Nicole:And my mom was in accounting and she was climbing as well.

Kendra Nicole:And so I always saw that and was just like, okay.

Kendra Nicole:This is what I want to do is like climb and just become this top executive.

Kendra Nicole:And, he was the first black man to do this at Toyota.

Kendra Nicole:And I was like, I'm going to be the first black woman to do this.

Kendra Nicole:And so I wanted, I wanted that, that was success to me.

Kendra Nicole:and so because I also had, like I said, amazing bosses and

Kendra Nicole:leadership, it felt easy to do.

Kendra Nicole:So I was like, okay, yeah, that's great.

Kendra Nicole:This is, this is, What I'm going to do.

Tim Winders:so here's what I noticed.

Tim Winders:I came out and I did corporate for a little while.

Tim Winders:I had already started a business though, and I'm probably 20 years

Tim Winders:ahead of you or before you, I guess.

Tim Winders:And one of the things that I realized as I was thinking about that corporate

Tim Winders:ladder was that paradigm of 30 years, be in one spot forever, it

Tim Winders:didn't seem to play out like that.

Tim Winders:Much.

Tim Winders:I'm not saying it's totally gone, but at what point did you realize

Tim Winders:it may not be that what your dad had as success, which was 30 years,

Tim Winders:same spot, moving up, same company, pension plan, all that kind of stuff.

Tim Winders:Did, did that, did that, did you realize at some point,

Tim Winders:Hmm, a little bit different.

Kendra Nicole:Oh, absolutely.

Kendra Nicole:and my dad realized it too, because every two years I was changing companies,

Kendra Nicole:not even just positions, but companies and sometimes States altogether.

Kendra Nicole:And so my dad, I remember, when I left GE actually, which I was

Kendra Nicole:there probably like four years.

Kendra Nicole:So he really thought that was going to be like, he was like,

Kendra Nicole:Oh, she's going to be her Toyota.

Kendra Nicole:I knew he, I know he thought that.

Kendra Nicole:And so when I left there, not only did I leave the company, but I left the state

Kendra Nicole:and he was just like, What are you doing?

Kendra Nicole:You're moving again.

Kendra Nicole:You're changing again.

Kendra Nicole:Like, what are you doing?

Kendra Nicole:so I knew in that moment, I didn't, it wasn't about entrepreneurship.

Kendra Nicole:I just knew that I wasn't going to be the 30 year lifer to one company.

Kendra Nicole:and I was all about, Hey, Dad, every time I move and change positions, I

Kendra Nicole:learned something vastly different.

Kendra Nicole:That I couldn't learn if I just stayed in the same company.

Kendra Nicole:And, I very, I very clearly still remember that conversation.

Tim Winders:Did you ever, did you regret or not regret, or did you like

Tim Winders:hesitate to communicate with him when you were about to make a move at the reason

Tim Winders:I bring up, this has been years ago.

Tim Winders:My mother, I was, I was at Bell South large corporation for about nine years

Tim Winders:and I had 10 jobs over the course of those nine years, moved around,

Tim Winders:bounced around mostly the Atlanta area because they were based there.

Tim Winders:And I remember my mom, which probably was my dad saying something similar was,

Tim Winders:can't you find anything that you can do?

Tim Winders:Or can't you settle in?

Tim Winders:And I, I, the answer was no, not really because of, it just

Tim Winders:wasn't that environment anymore.

Tim Winders:Did you, did you have, and and I'll say it this way.

Tim Winders:Was there a sense of, I don't like using the word failure, so we might could try

Tim Winders:to use another word, but was there ever a

Tim Winders:sense of Failure because it wasn't that model that you knew from your family.

Kendra Nicole:yeah, that's a really good question.

Kendra Nicole:I would say it was, and I agree that failure might not be the

Kendra Nicole:right word, but that it was.

Kendra Nicole:Maybe like disappointment where maybe I felt like I was kind of

Kendra Nicole:disappointing my dad because I'm not exactly doing it, the way that he did.

Kendra Nicole:Meanwhile, my mom is like, go for it.

Kendra Nicole:whatever, whatever it makes you happy.

Kendra Nicole:so I always had that balance, which was great.

Kendra Nicole:but yeah, I definitely feel like there was a sense of, Disappointing

Kendra Nicole:him by not going in that exact.

Tim Winders:Right.

Tim Winders:Good.

Tim Winders:All right.

Tim Winders:So you moved around a good bit and had some corporate experience.

Tim Winders:Give me, and maybe this is high level, low level, whatever.

Tim Winders:Give me maybe the best thing or the top thing that you learned during that time.

Tim Winders:And then maybe something that wasn't as positive that you, that you kind of have

Tim Winders:taken from those years, Kendra, the early years or whatever we want to call it.

Kendra Nicole:Yeah.

Kendra Nicole:so I was in corporate for sure.

Kendra Nicole:One of the big things that I learned was the relationships.

Kendra Nicole:So the, like I said, the, the CFO and how she would kind of bring some of

Kendra Nicole:this, us women, like under her wing.

Kendra Nicole:And then even the relationship between the CFO and the CEO, that's kind of.

Kendra Nicole:How my love for this whole fractional CFO business, how that came about

Kendra Nicole:because I saw the relationship between the CEO how they would not move

Kendra Nicole:forward in the business without coming together in the boardroom and talking

Kendra Nicole:over the numbers and all the things.

Kendra Nicole:so relationships is something that was, a large part of my learnings in corporate.

Kendra Nicole:and I would say on the opposite end of that, it might be, honestly,

Kendra Nicole:maybe something similar in that if you're, if you're not.

Kendra Nicole:making those great relationships.

Kendra Nicole:Sometimes it's not about how great you are and how great of the work

Kendra Nicole:that you can do, but it's maybe about your lack of relationship.

Kendra Nicole:And so it's, it's kind of one of those, I guess, double edge swords where it

Kendra Nicole:could be great and amazing if you had the relationship and it was built the

Kendra Nicole:way that, whoever thinks that it should be built, but if you don't have it, you

Kendra Nicole:might miss out on certain opportunities.

Tim Winders:I think I heard someone say one time that they were

Tim Winders:talking about business or something.

Tim Winders:They said, yeah, the best thing about what we do, they're the people.

Tim Winders:And then they said, the worst thing about what we do are the people.

Tim Winders:And I, I do see that now as you.

Tim Winders:Transition to when you left corporate, did you start your own thing immediately?

Tim Winders:Did you decide you were leaving?

Tim Winders:Was it a side hustle?

Tim Winders:What was that transition like moving away from that corporate experience?

Kendra Nicole:So entrepreneurship literally fell in my lap.

Kendra Nicole:And I know it's like cliche when folks say that it truly did.

Kendra Nicole:I was climbing this ladder.

Kendra Nicole:I had the goal to get, the floor to ceiling glass windows, corner

Kendra Nicole:office, like that was my goal.

Kendra Nicole:And, but I had friends who were starting businesses and who were

Kendra Nicole:doing great in their business.

Kendra Nicole:I mean, they were making millions of dollars.

Kendra Nicole:And sales and their business each year.

Kendra Nicole:And so I'm thinking, and they're on social media, like, about

Kendra Nicole:all their sales and everything.

Kendra Nicole:And I'm like, Oh, they're just living the life.

Kendra Nicole:But then behind closed doors, they'll come to me and they'll say, I'm struggling.

Kendra Nicole:Like these numbers aren't making sense.

Kendra Nicole:Can you help me?

Kendra Nicole:And so I'm like, sure.

Kendra Nicole:Put me in touch with your accountant.

Kendra Nicole:And they don't have an accountant.

Kendra Nicole:They're like, I don't have an accountant.

Kendra Nicole:What are you talking about?

Kendra Nicole:And so I'm like, how are you making millions in your business?

Kendra Nicole:And you don't have an accountant, a bookkeeper, anything.

Kendra Nicole:And so that's when I started to work with them on the side, not thinking

Kendra Nicole:at all, this would be a business, just thinking I'm helping out a few friends.

Kendra Nicole:But those first couple of friends after a few months in their business, completely

Kendra Nicole:turning around just because they had visibility into what they were doing.

Kendra Nicole:And of course, as an entrepreneur, if your business is doing

Kendra Nicole:well, then like your life.

Kendra Nicole:Like it's a personal thing, and so when I saw that turnaround for them after

Kendra Nicole:just a few months of working together, it clicked instantly that like, this

Kendra Nicole:is what I'm supposed to be doing.

Kendra Nicole:So like corporate was like paid training to be able to help these women in

Kendra Nicole:real life, with their small business, make, Changes in their business.

Kendra Nicole:And so once I saw that I was like, gee, he's going to make billions of

Kendra Nicole:dollars, whether I show up to work or not, but these women might close the

Kendra Nicole:doors if we don't show up for them.

Kendra Nicole:that's how the transition happened.

Kendra Nicole:And I would say after about five or six months of kind of side hustling

Kendra Nicole:it with friends on the side is when I left corporate and started full time.

Tim Winders:And so one of the things that comes up when we talk

Tim Winders:about business owners, let me address this before I move farther.

Tim Winders:It's amazing how sometimes social media doesn't portray the whole story.

Tim Winders:you said, Oh, they're killing it.

Tim Winders:They're doing so great.

Tim Winders:And then, and yeah, they might have that revenue come in, but

Tim Winders:there's the behind the curtain.

Tim Winders:It wouldn't be great if we actually hadn't, A true reading

Tim Winders:or gauge of, of what's going on.

Tim Winders:So you kind of get to look under the hood a good

Tim Winders:bit with people, which is pretty powerful.

Tim Winders:And you could probably find out what's really going on before we get

Tim Winders:into some of those details though.

Tim Winders:I'm always fascinated when I talk to people that deal with money.

Tim Winders:And, and I want to, there's a couple of things I want to talk about here before

Tim Winders:we kind of go into all the services you provide and what you're doing

Tim Winders:and some things we could learn from the people that you're working with.

Tim Winders:And that is what has been over the course of your life, what has been

Tim Winders:your relationship with money and what has been some of the things

Tim Winders:you've learned from seeing how other people, especially business

Tim Winders:people and owners deal with money.

Tim Winders:So first of all, talk about money.

Tim Winders:Is it something that drives you?

Tim Winders:Is it something you've always thought about?

Tim Winders:You've always been good at dealing with it or anything you want to

Tim Winders:share about money air quotes for those that are listening in here.

Kendra Nicole:Yeah.

Kendra Nicole:So I love this question.

Kendra Nicole:Now, when I used to hear this question or something similar, I would get anxiety

Kendra Nicole:because I actually have always had a pretty good relationship with money.

Kendra Nicole:My dad has, when he was climbing that ladder, he paid for our college.

Kendra Nicole:Like he, he bought our first cars for us, for me and my siblings.

Kendra Nicole:Like, So I've always had a good relationship with money.

Kendra Nicole:And so when I first started, I used to always think, man, no,

Kendra Nicole:one's going to really want to work with me because they're going to

Kendra Nicole:think, this girl comes from money.

Kendra Nicole:Like she doesn't understand me and my struggles in my business.

Kendra Nicole:She comes from money, not realizing that just because I had

Kendra Nicole:the ability to get money from my family didn't mean that I did.

Kendra Nicole:I struggled.

Kendra Nicole:Like every other entrepreneur struggles.

Kendra Nicole:I struggled in college, like every other college kid struggles.

Kendra Nicole:and, but I say that because when I would first hear that question

Kendra Nicole:before, I would always think, okay, man, people, everyone's always got

Kendra Nicole:the, rags to riches story and I don't have this rags to riches story.

Kendra Nicole:So anyways, that's, that's my true relationship with money is it was never.

Kendra Nicole:Oh, I have to accumulate so much of this or, but just like it was never

Kendra Nicole:a, Oh, I don't have enough of it.

Kendra Nicole:There was never really any, deep thought around money, except for I

Kendra Nicole:know that it can make people happy.

Kendra Nicole:For example, I always think of this story when, when my dad would take

Kendra Nicole:like our whole family, like cousins and aunts and uncles out to eat.

Kendra Nicole:And he'd always pick up the tab for the whole table.

Kendra Nicole:And I would just always see how everyone, no one ever has to worry about like,

Kendra Nicole:who's going to pick up the tab, right?

Kendra Nicole:Things like that.

Kendra Nicole:That's my thought when it comes to money is being able to do that, it's,

Kendra Nicole:and so hopefully that answers your question, but that's, that's kind of

Kendra Nicole:what my relationship was with money.

Kendra Nicole:And, and even now to this day, it's always, When I'm talking to like my, my

Kendra Nicole:business owners and I'm working with, I'm always trying to understand what their

Kendra Nicole:relationship is with money and where some of these almost like arbitrary goals come

Kendra Nicole:from, because you always hear the, I want a million dollars of sales this year,

Kendra Nicole:or I want 500 K in my savings account.

Kendra Nicole:What?

Kendra Nicole:Why?

Kendra Nicole:Like, what are these numbers tied to?

Kendra Nicole:so I always try to get a better understanding of that from them as well.

Tim Winders:The reason this is kind of a neat conversation.

Tim Winders:I didn't realize it when we were scheduling this interview, but the last

Tim Winders:interview I did was with Steven DeSilva that it probably will release right

Tim Winders:before this episode for those that might want to search, we actually discussed.

Tim Winders:prosperity and money from a spiritual tone.

Tim Winders:And I think that's a great foundation for a lot of people.

Tim Winders:And then I think next week, the next one we're having is talking to someone

Tim Winders:who's kind of like a wealth advisor.

Tim Winders:And so I'm looking at our conversation here is like, business

Tim Winders:owner, how to deal with like some practical and things like that.

Tim Winders:So I think, I think these three, this arc is going to be a great combination, but I

Tim Winders:do think that we learn a lot about people in two situations when they have a lack

Tim Winders:or extreme lack of financial resources and possibly when they have An abundance or an

Tim Winders:extreme abundance of financial resources.

Tim Winders:Would you agree with that?

Tim Winders:And is there anything you want to say about that?

Kendra Nicole:100%.

Kendra Nicole:100%.

Kendra Nicole:I, I totally agree with that.

Kendra Nicole:I think Sometimes on the abundance side, what can show up is the

Kendra Nicole:insecurities that the people might have.

Kendra Nicole:And, sometimes that money is or that what we think is abundance or excess of money

Kendra Nicole:is used to kind of, fix or resolve or gloss over some of those insecurities.

Kendra Nicole:And so I definitely.

Kendra Nicole:I definitely agree 100 percent that you can really see someone on both of

Kendra Nicole:those, ends of the spectrum for sure.

Tim Winders:Yeah.

Tim Winders:And I think what that does is it, it, it can really manifest when someone has a

Tim Winders:great idea, they have a business, they're trying to provide a service, and then

Tim Winders:all of a sudden they're doing all those business things, and we're dealing with

Tim Winders:either a lot of money coming in or we're Things are tied and things like that.

Tim Winders:So, so with that, let's transition and let's talk about some of the things

Tim Winders:that you've seen, maybe high level.

Tim Winders:And then we'll go down practical with that mindset about money.

Tim Winders:Maybe let's start with mindset.

Tim Winders:You've interacted with a lot of females, it sounds like, and.

Tim Winders:And and I know you don't want to mention names or anything here, but what are some

Tim Winders:ways that you've seen people handle the mindset of money well, and maybe some

Tim Winders:examples when people it's like, okay, this is something that we're going to have to

Tim Winders:exercise these demons to get this to where we could really be, do well financially.

Tim Winders:And I'll mention a couple of things after you say that, but any, anything

Tim Winders:popped to mind when I bring that up?

Kendra Nicole:Yeah.

Kendra Nicole:I would say some of the, some of the biggest like struggles or hurdles

Kendra Nicole:will come through when, when one is extremely creative and, maybe coming up

Kendra Nicole:with several different ideas and, or, concepts and everything has to go live.

Kendra Nicole:Now, like I have to launch everything today and then I come

Kendra Nicole:up with a new idea in a week and I want to launch that one too.

Kendra Nicole:And, and sometimes that's just because they're super creative, but sometimes

Kendra Nicole:it's also out of fear that what I launched last week might not bring enough money.

Kendra Nicole:So let me create something else.

Kendra Nicole:And so they have.

Kendra Nicole:100 things that are 85 percent complete, but nothing that's 100

Kendra Nicole:percent across the finish line.

Kendra Nicole:And so they're tacked out emotionally, physically, financially, because I

Kendra Nicole:can't get anything to the finish line because I keep starting these new things.

Kendra Nicole:And so I do see that often with those, That are just extremely

Kendra Nicole:creative and come up with these different concepts and ideas.

Kendra Nicole:And I think that sometimes that does come out of fear of, well, these other

Kendra Nicole:things that I created might not be enough or might not get bring in what

Kendra Nicole:I need to let me create something else.

Kendra Nicole:That's definitely 1 that I see another 1 is with the social media.

Kendra Nicole:Side of seeing the success of everyone else and thinking that

Kendra Nicole:they don't have that success.

Kendra Nicole:And so they're chasing that in chasing someone else's success is extremely

Kendra Nicole:expensive on all of your resources on your money, on your energy, on your time.

Kendra Nicole:you can't chase someone else's success.

Kendra Nicole:You don't know what their success actually is.

Kendra Nicole:So it's this, it's just this like never ending.

Kendra Nicole:thing that you're kind of running after.

Kendra Nicole:And I see that often as well.

Kendra Nicole:And I get it.

Kendra Nicole:It's hard, but, but I do see that quite a bit as well.

Tim Winders:Yeah, the comparison trap is so challenging and I would

Tim Winders:say, years ago when I was starting my first businesses, you could just look

Tim Winders:around and see two or three people.

Tim Winders:Now you could look around and see two or 300 or two or 3000 and boy they

Tim Winders:all look, they are, they look like they're just killing it and doing

Tim Winders:so great and living their best life.

Tim Winders:And that's why I like talking to people that are in the CFO role.

Tim Winders:'cause they sometimes.

Tim Winders:No, really, like I said earlier, what's, what's under the hood.

Tim Winders:Do you ever run across entrepreneurs, business owners?

Tim Winders:I know that I deal with this and I deal with mostly males.

Tim Winders:I'm not exclusive, but that they're just delusional.

Tim Winders:They just have no clue or concept.

Tim Winders:Don't mention names here, if it's true, but they are, they're probably

Tim Winders:good at some of the things, but when it comes to the financial

Tim Winders:piece, they are living in dreamland.

Tim Winders:It's that you see that often.

Tim Winders:I

Kendra Nicole:Yeah, I won't say that I see it often.

Kendra Nicole:I do see it.

Kendra Nicole:I do see it occasionally though.

Kendra Nicole:and it's hard because I feel like usually when I see it, it's because they're,

Kendra Nicole:It's less of the lack of knowledge of financials, which is absolutely part

Kendra Nicole:of it, but it's more of they're just so incredibly passionate about whatever it

Kendra Nicole:is that they're trying to get to market.

Kendra Nicole:And they, and they, and it might be life changing.

Kendra Nicole:It might, it might change the lives of however many people

Kendra Nicole:sign up for that app or take that technology and do whatever it is.

Kendra Nicole:But, but it's, it takes money to get there.

Kendra Nicole:It takes the marketing efforts to get there.

Kendra Nicole:It takes the investments to get there.

Kendra Nicole:And sometimes.

Kendra Nicole:there's this, if you build it, they will come kind of mentality and

Kendra Nicole:entrepreneurship that like, I mean, I had it as well when I first started

Kendra Nicole:the business, like you get humbled very quickly, and entrepreneurship,

Kendra Nicole:like that's just not how it works.

Kendra Nicole:And so I think sometimes there's a little bit of that, where you just

Kendra Nicole:kind of have to let them see a little bit of it to understand, like, it can

Kendra Nicole:be an amazing idea, concept, whatever it is, but it, it takes more than

Kendra Nicole:that in order for it to be successful.

Tim Winders:noticed with me, that was, we were talking about superpowers earlier.

Tim Winders:I think it was one of my superpowers.

Tim Winders:Up to a point, but an overused superpower sometimes can be our kryptonite.

Tim Winders:It can, it can draw down what I had extreme optimism and I really had a

Tim Winders:vision for the future of where we were headed and where we were going, the

Tim Winders:disconnect or the challenge was, is that it's hard to spend future money.

Tim Winders:I think people can borrow and things like that.

Tim Winders:That's not a good formula for profit.

Tim Winders:People like me that have that mindset.

Tim Winders:And so I was living off future money, and I would say things

Tim Winders:like, Oh, I'm investing in myself or I'm, I'm putting money back in.

Tim Winders:We're investing back in.

Tim Winders:But the, I won't get into the whole story, but in 08, we had real estate

Tim Winders:companies in that, that came to an end fairly quickly, how, how does someone

Tim Winders:who is a CFO or accountant or someone who's working with someone like that.

Tim Winders:How can you approach it to reel someone like that in without

Tim Winders:squelching all of that energy?

Tim Winders:That might be a hard question, but I'd love to know because

Tim Winders:that's my background and probably a lot of listeners backgrounds.

Kendra Nicole:find the best thing is to understand is to really understand each

Kendra Nicole:individual person and what drives them because you can be extremely optimistic

Kendra Nicole:and have these these thoughts and these these plans and and also be the type that

Kendra Nicole:if I were to bring you data of, maybe historical things that have happened or

Kendra Nicole:data of projections of what might happen.

Kendra Nicole:you might be the type that can sit down and look at that, and that can

Kendra Nicole:actually be enough to kind of sway you one way or another, if you're kind

Kendra Nicole:of data driven, or you might be one that can care less about the data.

Kendra Nicole:I have those clients as well.

Kendra Nicole:Kendra, I don't care what the numbers say.

Kendra Nicole:I feel this in all of my aura.

Kendra Nicole:And I'm like, okay, yeah.

Kendra Nicole:Let's go another about this another way.

Kendra Nicole:And so then I might tap into more of the, well, why are you wanting to do this?

Kendra Nicole:And if I can get a better understanding of what their why is and what their end goal

Kendra Nicole:is beyond this, then maybe there are other avenues that we can take that might be

Kendra Nicole:less risk or, less of a financial burden right now that we can still get closer

Kendra Nicole:to that why without as big of a jump and then sometimes it's just, You know what?

Kendra Nicole:You're right.

Kendra Nicole:Like this might be a big vision, a big dream.

Kendra Nicole:It might be a big risk, but this sounds, this actually all kind of shakes out

Kendra Nicole:and it looks good, let's go for it.

Kendra Nicole:But let's check in often to make sure that it's going the way that we're

Kendra Nicole:thinking that it should go and pivot when necessary versus like, let's

Kendra Nicole:just throw it out there and just like sit back and kind of let it cook.

Tim Winders:Yeah.

Tim Winders:The thing that's the reason that's so good Kendra is is the ability to access the

Tim Winders:data is where people like you, I think, bring extreme value to people like that.

Tim Winders:I've got a call later today with one of my clients, runs a company and he generally

Tim Winders:knows in his head what's going on.

Tim Winders:He's a real detailed type person, but boy, he needs that, we, I think

Tim Winders:we call it a CFO in his organization to track, look at trends, look

Tim Winders:at things that might be problems.

Tim Winders:Look at, what happened last year, what's happening this year, what

Tim Winders:we, what might we do next year.

Tim Winders:And I think that that Becomes important.

Tim Winders:I noticed with your, your business that you use terms like fractional CFO.

Tim Winders:we talk about obviously accounting and there's other words like

Tim Winders:comptroller and things like that.

Tim Winders:I think before we kind of go any further, could you for myself and others define

Tim Winders:what you mean by some of those roles?

Tim Winders:Cause I think.

Tim Winders:There's some people that would say CFO.

Tim Winders:Oh, that's not for me.

Tim Winders:That's like a big corporate type thing.

Tim Winders:And that could be your corporate background, knowing the role they have.

Tim Winders:But talk about those.

Tim Winders:whatever you want to do, CFO, accountant, controller,

Tim Winders:bookkeeper, all of those, I think are sometimes lumped all together.

Tim Winders:And I do think there's differences.

Kendra Nicole:yeah, absolutely.

Kendra Nicole:so I'll start with kind of your bookkeeper.

Kendra Nicole:So if you are, if you, so essentially what they are for.

Kendra Nicole:So a bookkeeper essentially is responsible for, accurately classifying

Kendra Nicole:from an accounting standpoint, every transaction, every financial transaction

Kendra Nicole:that you make in your business.

Kendra Nicole:So every time you swipe your debit card to buy some supplies, or every time

Kendra Nicole:you get a invoice paid from a client, a bookkeeper's job is to ensure that

Kendra Nicole:that is being classified properly.

Kendra Nicole:So that when you run a financial statement, like a profit and loss or a

Kendra Nicole:balance sheet or a cashflow statement, everything is on there accurately, and in

Kendra Nicole:a compliant fashion, so that when you go to file your tax return and everything,

Kendra Nicole:it's all like on there properly.

Kendra Nicole:and an accountant is like the level above that your accountant also

Kendra Nicole:should understand some deeper laws for your business, for your location.

Kendra Nicole:Okay, maybe there are some, journal entries, which is.

Kendra Nicole:Fancy way of saying, some like adjustments that need to be made in your books

Kendra Nicole:to ensure that it's also compliant.

Kendra Nicole:So where the bookkeeper might kind of understand things at a transactional

Kendra Nicole:basis, your accountant kind of understands things that are, higher, business level.

Kendra Nicole:and then your CFO, let me pause there for a second.

Kendra Nicole:You're so that means that your bookkeeper and your accountant, they're all

Kendra Nicole:looking at historical transactions.

Kendra Nicole:They're looking at things that have happened in the past.

Kendra Nicole:The money that you've spent, the money that you've made.

Kendra Nicole:and, and a CFO is more forward looking.

Kendra Nicole:So we come in, we have to have accurate accounting.

Kendra Nicole:So we need a bookkeeper and an accountant to, to, to do our jobs because they

Kendra Nicole:give us all of that historical data.

Kendra Nicole:But then we take that historical data and then anything else is going on

Kendra Nicole:in the world and then understand, okay, well, if your business is

Kendra Nicole:currently here, how do we get it there?

Kendra Nicole:Or how do we get it here?

Kendra Nicole:Or how do we get it out of whatever?

Kendra Nicole:messy might feel like you're in.

Kendra Nicole:And CFO is more forward looking.

Kendra Nicole:we, we create strategies, we create projections, things like that, where

Kendra Nicole:your bookkeeper and your accountant are more present day or past historical.

Kendra Nicole:but we all work together in order to kind of create everything that's

Kendra Nicole:needed, but that's usually the step.

Kendra Nicole:And to your point about who really needs a CFO, you can, you can earn 20,

Kendra Nicole:30, 40, 000 a month in your business and have a fractional CFO because we

Kendra Nicole:can just come in and maybe help you understand how you're making 20 now.

Kendra Nicole:And if you want that 20 to be 40, we can understand the, the metrics within your

Kendra Nicole:business that help you get to that 20.

Kendra Nicole:Cause the 20 is just an end number, right?

Kendra Nicole:That's based off of maybe how many units you've sold or whatever your pricing is.

Kendra Nicole:So we can understand the economics of the, how you got to that 20 to

Kendra Nicole:figure out how to make that 20 or 40.

Kendra Nicole:That's when the CFO would come in, a fractional CFO would come in.

Kendra Nicole:100%.

Tim Winders:that many entrepreneur business owners will use when it comes

Tim Winders:to those services are something to the effect of we can't afford blank.

Tim Winders:Accountant, bookkeeper, CFO yet, and you just mentioned a dollar amount, but could

Tim Winders:you now go through that if you want to go through that list again and kind of

Tim Winders:give, what are some clues that you need?

Tim Winders:bookkeeper, accountant, or it's time for a CFO.

Tim Winders:It's time for fractional CFO.

Tim Winders:Do you, are there any metrics around that?

Tim Winders:Or are there any, is there anything that someone listening

Tim Winders:or someone gauging it would say, okay, this is a trigger for this.

Kendra Nicole:So if you're making about 100, 000 a year in sales, whether

Kendra Nicole:you're product based, service based, whatever, 100, 000 a year in sales, which

Kendra Nicole:is about 8, 000, a little over 8, 000 a month in income, then you definitely

Kendra Nicole:want to at least consider a bookkeeper.

Kendra Nicole:Now that's on the, absolutely, like that's a trigger that should absolutely

Kendra Nicole:make you want to bring in a bookkeeper.

Kendra Nicole:But if you're bringing in 5, 000 and it's overwhelming to you.

Kendra Nicole:Then you can consider bringing in a bookkeeper as well because there

Kendra Nicole:are some bookkeepers as low as, a couple hundred dollars a month.

Kendra Nicole:There are some, SAS tools like bench.

Kendra Nicole:co that I think it's like 140 a month maybe, and you don't have a person that

Kendra Nicole:you're kind of working with one on one, but it's a, it's a solution, a tool that

Kendra Nicole:kind of automate some of your bookkeeping.

Kendra Nicole:So if you're, if it's overwhelming, go ahead and outsource it.

Kendra Nicole:But if you.

Kendra Nicole:don't feel like it's that overwhelming, but you're already

Kendra Nicole:at that 100k a year threshold.

Kendra Nicole:I would say still go ahead and consider investing in a bookkeeper.

Kendra Nicole:the accountant that really comes in more so depending on the

Kendra Nicole:complexity of your business.

Kendra Nicole:So if you're purchasing a lot of like assets, whether it's real

Kendra Nicole:estate or whether it's a lot of equipment that you're purchasing,

Kendra Nicole:if you're doing like manufacturing.

Kendra Nicole:Then you want to consider an accountant because they're going

Kendra Nicole:to look at some of those entries that we talked about earlier.

Kendra Nicole:and that would also be probably at that 100k or more range before you're,

Kendra Nicole:obviously investing in like equipment.

Kendra Nicole:now a CFO, I usually say if you're making about 250k a year or more,

Kendra Nicole:sometimes it's like 500k a year or more.

Kendra Nicole:It really just depends on what you're doing that you want to bring in a CFO.

Kendra Nicole:It's almost less about the dollar amount though, and more about

Kendra Nicole:what's going on in your business.

Kendra Nicole:So CFOs are great when you're going through some kind of a

Kendra Nicole:transitional point in your business.

Kendra Nicole:maybe you're hiring your first full time employee outside of yourself, or

Kendra Nicole:maybe you are going from one location to two locations, or you're going

Kendra Nicole:from being a dot com to opening up a brick and mortar location as well.

Kendra Nicole:So when there are some Larger transitional points are happening

Kendra Nicole:in your business that you want to consider bringing on a fractional CFO.

Kendra Nicole:Cause it might even just be for that project.

Kendra Nicole:It might not be an ongoing commitment.

Kendra Nicole:It might be for the next three months.

Kendra Nicole:As I consider bringing on this next employee, I really need somebody that

Kendra Nicole:I can run this scenario through and help me go through these numbers.

Tim Winders:Those are good gauges.

Tim Winders:I appreciate you giving us some, some indicators there.

Tim Winders:One of the things that also came to mind is I think it was before I want to

Tim Winders:talk about the next thing is how often, and you, and you may not interact with

Tim Winders:these I think many times entrepreneurs and business owners, there's a

Tim Winders:statement that I make often and it's called thou shalt not fool thyself.

Tim Winders:I think we will often fool ourselves thinking, Oh, it's just numbers.

Tim Winders:I can keep track of that.

Tim Winders:Oh, it's just marketing.

Tim Winders:I can do marketing.

Tim Winders:Oh, it's just social media posts.

Tim Winders:I could do that.

Tim Winders:We really don't.

Tim Winders:Do this is goes back to the delusional thing.

Tim Winders:I think there's a delusion that we either can do it all or we have to do it all.

Tim Winders:So how often do you have to deal with folks that are like, I know I could do

Tim Winders:it, but I feel like I just need help.

Tim Winders:Or.

Tim Winders:I think women are probably better at admitting they can't do things.

Tim Winders:Maybe I'm wrong about that, but how often do you have to

Tim Winders:say, okay, let us handle this.

Tim Winders:You go do what it is.

Tim Winders:You're really good at.

Tim Winders:I think sometimes entrepreneurs are not good at that.

Tim Winders:So talk about that.

Tim Winders:Some,

Kendra Nicole:yeah, I 100 percent agree.

Kendra Nicole:And, and, and it's, it's a thing with women as well, for sure.

Kendra Nicole:we'll often hear folks on calls say like.

Kendra Nicole:I know I'm sure I could do this, I'm sure I can like create my own

Kendra Nicole:projection for this three year plan for the sales pitch or the, the investor

Kendra Nicole:pitch that I have coming up, but you know, I would rather just outsource it.

Kendra Nicole:I'm like, okay, I'm sure you probably could do it, but wouldn't you want

Kendra Nicole:someone who does this for a living?

Kendra Nicole:To do it, it's like I, I probably could write a book in Portuguese, using chat GPT

Kendra Nicole:and Google, but what, what I really want to write a book in Portuguese versus going

Kendra Nicole:to someone who can write in Portuguese.

Kendra Nicole:yes, it does take, I think sometimes it just takes having the conversation with

Kendra Nicole:whoever that potential fractional CFO is for you to get comfortable with the idea.

Kendra Nicole:Of someone else taking it over.

Kendra Nicole:Cause I do think at least with, within finance and accounting, that a little

Kendra Nicole:bit of that is the, concern of someone is about just kind of see all of my mess.

Kendra Nicole:And so they really are almost like talking themselves out of bringing

Kendra Nicole:somebody on because they don't want someone to see all of their mess.

Kendra Nicole:but usually that goes away very, very quickly once they have their

Kendra Nicole:first set of books done for them.

Kendra Nicole:And they're like, Oh, this is this is great.

Kendra Nicole:I didn't have to do a thing.

Kendra Nicole:so it happens.

Kendra Nicole:I'm the same way with marketing.

Kendra Nicole:I'm always like, Oh, I can do my own marketing and then nothing

Kendra Nicole:gets done for like 6 months.

Kendra Nicole:So I get it.

Kendra Nicole:but usually once they hand the reins over, it's very easy.

Kendra Nicole:Easy for them to then see like, Oh, I should have done this a long time ago.

Tim Winders:yeah.

Tim Winders:Or you get it done and it's done poorly.

Tim Winders:And there's some pretty, I don't want to say severe repercussions.

Tim Winders:There's some repercussions if you

Tim Winders:don't handle the, okay.

Tim Winders:Financial pieces, right?

Tim Winders:I I've interacted with clients in the past that have brought up things

Tim Winders:that sound something like this.

Tim Winders:I'll mention this and then let you respond something like this.

Tim Winders:Oh, we've paid our taxes, but we haven't done a return in three or four years.

Tim Winders:Which is an interesting.

Tim Winders:Or yeah, we've been a little bit at tight.

Tim Winders:We're a little bit behind on our tax situation and we'll get caught

Tim Winders:up as soon as blank happens.

Tim Winders:When you hear things like that, as someone who deals with the financial

Tim Winders:piece, what goes through your mind?

Kendra Nicole:I, it's tough because you don't want to like ring the alarms, but

Kendra Nicole:at the same time you, you have to kind of wake, wake them up a little bit to

Kendra Nicole:the, to the realities of what's going on.

Kendra Nicole:and then also like, yes, there's the repercussions with, with taxes for

Kendra Nicole:sure, which is definitely something that you don't want to mess with.

Kendra Nicole:But then also Bad data, bad financial data hurts you every single day in your

Kendra Nicole:business, because especially if you're using that data to make decisions,

Kendra Nicole:garbage in, garbage out, right?

Kendra Nicole:So if I'm trying to determine how I'm going to scale my business

Kendra Nicole:based on garbage data, I'm not going to scale my business properly.

Kendra Nicole:It's going to, go any old kind of way.

Kendra Nicole:bad.

Kendra Nicole:I always let folks know that bad financial data, like this is beyond

Kendra Nicole:the scary taxman, which is a scary tax man, by the way, it really is, but

Kendra Nicole:beyond the tax man, it's your day to day decision making that's also on the line.

Kendra Nicole:So why make, why grow a business with, with this, this incomplete data, when

Kendra Nicole:you can have information in front of you that helps you make decisions.

Kendra Nicole:Everyday decisions, the decisions that we all have to make is my pricing, right?

Kendra Nicole:How much should I, offer this person for this full time job?

Kendra Nicole:Like, these are questions that we have to make that looking

Kendra Nicole:at data would help us make,

Tim Winders:I think it's just being a good steward of

Tim Winders:what you've been gifted with.

Tim Winders:It's something we talk about a good bit here.

Tim Winders:That's, I think that's the right thing spiritually.

Tim Winders:I think it's just the right thing.

Tim Winders:If you've got a business, you need to steward it and take

Tim Winders:care of it in a certain way.

Tim Winders:And part of that are the numbers.

Tim Winders:Part of that is the people, part of it's other assets and other

Tim Winders:things that you've been gifted with.

Tim Winders:And so I, I, I think.

Tim Winders:I think it's something that you just need to take care of better.

Tim Winders:And it seems like that's what you bring into the business.

Tim Winders:You've got something that I read about called peace and profits and, and, In

Tim Winders:the same sentence that I was reading it, it said something about, stop the

Tim Winders:hustle or stop the hustle and grind, which is near and dear to my heart.

Tim Winders:I was the early part of my life up until probably, 20 minutes

Tim Winders:ago, I would have been kind of a hustle and grind type person.

Tim Winders:No, actually about 15 years ago is when I started getting purged of that.

Tim Winders:And so anytime I see something, it might've been what attracted me for

Tim Winders:us to have this conversation, peace and profits and, avoid the hustle.

Tim Winders:It, it means something to me.

Tim Winders:So tell me about peace and profits and how those fit together.

Kendra Nicole:Yeah.

Kendra Nicole:as a CFO and someone who's in finance.

Kendra Nicole:It was always about profit to me because that's just kind of what made sense.

Kendra Nicole:I'm here to look at the data and the numbers to see what's going

Kendra Nicole:to be the most profitable thing.

Kendra Nicole:And even when I started my business, same concept, because I

Kendra Nicole:took that mentality from corporate and then, 2020 I had my son.

Kendra Nicole:And when I had my son, I thought that I had set myself up to have this like

Kendra Nicole:great maternity leave as an entrepreneur.

Kendra Nicole:I'm like, I'm in control of my own time.

Kendra Nicole:I can like, determine who I get to talk to and all of this, how many hours I work.

Kendra Nicole:And, that just wasn't the case.

Kendra Nicole:I, I was still grinding while, bouncing on a yoga ball while like, Nursing my

Kendra Nicole:son to sleep so that I could take a call and hoping that he doesn't wake up.

Kendra Nicole:Like, and it was that way for months and I was so drained.

Kendra Nicole:And, then it just clicked.

Kendra Nicole:And I had some clients who were completely understanding.

Kendra Nicole:And then I had some one in particular who roasted me on the call because

Kendra Nicole:I'm like rocking my son to sleep while I'm on the call with her.

Kendra Nicole:And that's when I realized like, okay, I really signed up for this entrepreneur

Kendra Nicole:thing because I knew that I could have a little bit more control over my

Kendra Nicole:life and who I work with and my time.

Kendra Nicole:And it's time that I really put that into place.

Kendra Nicole:And so that's when I started to transition my mindset from

Kendra Nicole:this business is all about.

Kendra Nicole:Helping people be profitable to this business is all about helping people

Kendra Nicole:be profitable, but so they can live a peaceful life so they can do whatever it

Kendra Nicole:is that they're wanting to do, whether that's spend more time with their

Kendra Nicole:family, whether that's travel the world, it's a combination of the two things.

Kendra Nicole:And it's, it then puts a purpose behind the profits.

Kendra Nicole:which ironically enough makes the profits grow because you're doing it for a reason

Kendra Nicole:and a reason that's in alignment with you.

Kendra Nicole:And yeah, that tipping point, really changed things and I still have my CFO

Kendra Nicole:hat on, but I always look at things through the lens of peace and profits.

Kendra Nicole:And, once you start down that path, like there's no going back, I can never go

Kendra Nicole:back to being like profit, profit, profit.

Kendra Nicole:Like I, it, it, it, I can't go down that path anymore.

Tim Winders:The interesting thing to tie back into something we talked

Tim Winders:about earlier, you mentioned that there are a lot of people that are chasing

Tim Winders:after Profits, business, new business, whatever chasing after a lifestyle that

Tim Winders:they think someone else is leading and they think they want to do that also.

Tim Winders:you mentioned the chasing and to me, that is almost the opposite of the

Tim Winders:wording of peace and profits and.

Tim Winders:And the anti hustle, do you still have people that come into your, your circle

Tim Winders:that they're going through this chasing?

Tim Winders:They're, they're on the wheel, the, we could call it a hamster wheel.

Tim Winders:We can call it a hustle and grind, all of these things.

Tim Winders:And I love what you just said.

Tim Winders:It's like, When you stop chasing, it's like when, if you're got a, if your

Tim Winders:dog goes outside and you're trying to

Tim Winders:run them down, but yet if you just kind of sit with something that they

Tim Winders:come after, is that, I mean, have you had observations that you can

Tim Winders:share with someone listening right now?

Tim Winders:It's like, stop chasing, slow down, And let the business come to you.

Tim Winders:That almost sounds like a Yoda type statement and all that, but any, I

Tim Winders:don't even know if that question made sense, but what do you want to say

Tim Winders:to anything about stop chasing, allow the peace and profits to come to you.

Kendra Nicole:Yes, and you're 100 percent like I would I'm I'm I always say like

Kendra Nicole:I am NOT a woo woo person My sister is so woo woo, right and I'm like, oh,

Kendra Nicole:you were just so I'm just not a woo woo person Until this shift with like peace

Kendra Nicole:and profits happened and I'm like, okay, wait, there's something to this There's

Kendra Nicole:a little there's a little woo in my life right now, and I'm accepting it because

Kendra Nicole:there's something You can, you can run and run and chase and chase all you want

Kendra Nicole:to and you will do it to exhaustion.

Kendra Nicole:but once you actually, understand your why behind things, which again, before

Kendra Nicole:I would have said, oh, it's so low, so low, but once you really understand that

Kendra Nicole:it grounds you in what you're doing.

Kendra Nicole:And absolutely.

Kendra Nicole:I mean, I definitely have clients who once I.

Kendra Nicole:Once I kind of saw the light and kind of brought that to them as

Kendra Nicole:well, it just changed our dynamic and our working relationship.

Kendra Nicole:It's changed how we, how we implement and execute things in their business.

Kendra Nicole:And some folks listen, some will come to me and we'll still

Kendra Nicole:want to chase and grind and work really hard on what they're doing.

Kendra Nicole:I understand that's the season that they're in.

Kendra Nicole:and I can, do the best that I can do to serve them.

Kendra Nicole:But, but yeah, it, it, it, it just, things just smooth out a lot more.

Kendra Nicole:Once you accept that there's two sides to this thing called entrepreneurship

Kendra Nicole:and it's not all about profits.

Kendra Nicole:Sure.

Kendra Nicole:You need profits to obviously continue to run and funnel your

Kendra Nicole:business, but you need peace too.

Kendra Nicole:You need peace too.

Kendra Nicole:and yeah, I, I love it.

Kendra Nicole:I'm so very grateful, for that client who roasted me on that call because

Kendra Nicole:I don't know, it would have taken me longer to get to this point.

Kendra Nicole:and yeah, I'm not going back.

Tim Winders:Do you find your, do you find that you're attracting people that fit?

Tim Winders:I mean, listen, when you use wording like peace versus scale, I mean,

Tim Winders:there's nothing wrong with scale.

Tim Winders:I'm an engineer by training and went.

Tim Winders:To school down the road from Clemson at Georgia Tech.

Tim Winders:And so systems engineering and scaling, those were part of my vocabulary,

Tim Winders:but I'm going to place in life where that piece part is really important.

Tim Winders:Are you attracting clients that aren't roasting you as much on phone calls now?

Kendra Nicole:100%.

Kendra Nicole:And those who come in for like consults that I can feel just

Kendra Nicole:the, the high, strong energy.

Kendra Nicole:That they're not on the peace and profit side and that they're still

Kendra Nicole:on this, like, I'm going to grind it out by any means necessary.

Kendra Nicole:I understand that's the season you're in, but we're probably not

Kendra Nicole:the best fit for you because I'm not going to move at that pace.

Kendra Nicole:I'm not going to tell you to drop any and everything that you do right now.

Kendra Nicole:To, accomplish X, Y, and Z with no thought about the other things that

Kendra Nicole:you want to accomplish in your life.

Kendra Nicole:And one of the call or one of the questions that we actually

Kendra Nicole:asked on the console call is like, what are you doing this for?

Kendra Nicole:Like, what, what's your reason for this business?

Kendra Nicole:And if it's just, I want a million dollars in the bank account.

Kendra Nicole:And I can't get any deeper than that, then we're probably not the best fit.

Kendra Nicole:But if it's like, I want a million dollars in my bank account, because

Kendra Nicole:that's the number that I hear is going to help me pay for my kids tuition.

Kendra Nicole:And I can retire when I'm whatever age, and there's like something else behind

Kendra Nicole:it that we can like really tie into.

Kendra Nicole:Then it's probably a better fit, a better alignment.

Tim Winders:Years ago, when I was coaching in the real estate investing

Tim Winders:space, I would have some people that would say something to the effect of,

Tim Winders:well, I need to make sure that I've got your phone number to text you, 24

Tim Winders:seven in case there's ever an emergency.

Tim Winders:Kendra.

Tim Winders:My response was this is real estate.

Tim Winders:There won't be an emergency.

Tim Winders:You don't need my text to text me.

Tim Winders:I mean, we'll, if you send me an email, I respond within 24 hours.

Tim Winders:I'll get back to you, but that's not, that's not, there

Tim Winders:are no real estate emergencies.

Tim Winders:I don't know.

Tim Winders:Are there ever any accounting or CFO emergencies?

Tim Winders:Take

Kendra Nicole:Don't know.

Kendra Nicole:if it's at the end of the day, there's always going to be time

Kendra Nicole:to sit and think things through.

Kendra Nicole:Actually, ironically, earlier today, a client of mine sent me

Kendra Nicole:over a a listing of a property that she's thinking about buying.

Kendra Nicole:And we've already had the conversation about if she should do real estate

Kendra Nicole:investing and things like that.

Kendra Nicole:So we've already kind of cleared that, but we had a cap.

Kendra Nicole:We had an amount that we were supposed to stick to, and this

Kendra Nicole:is far beyond that amount.