full

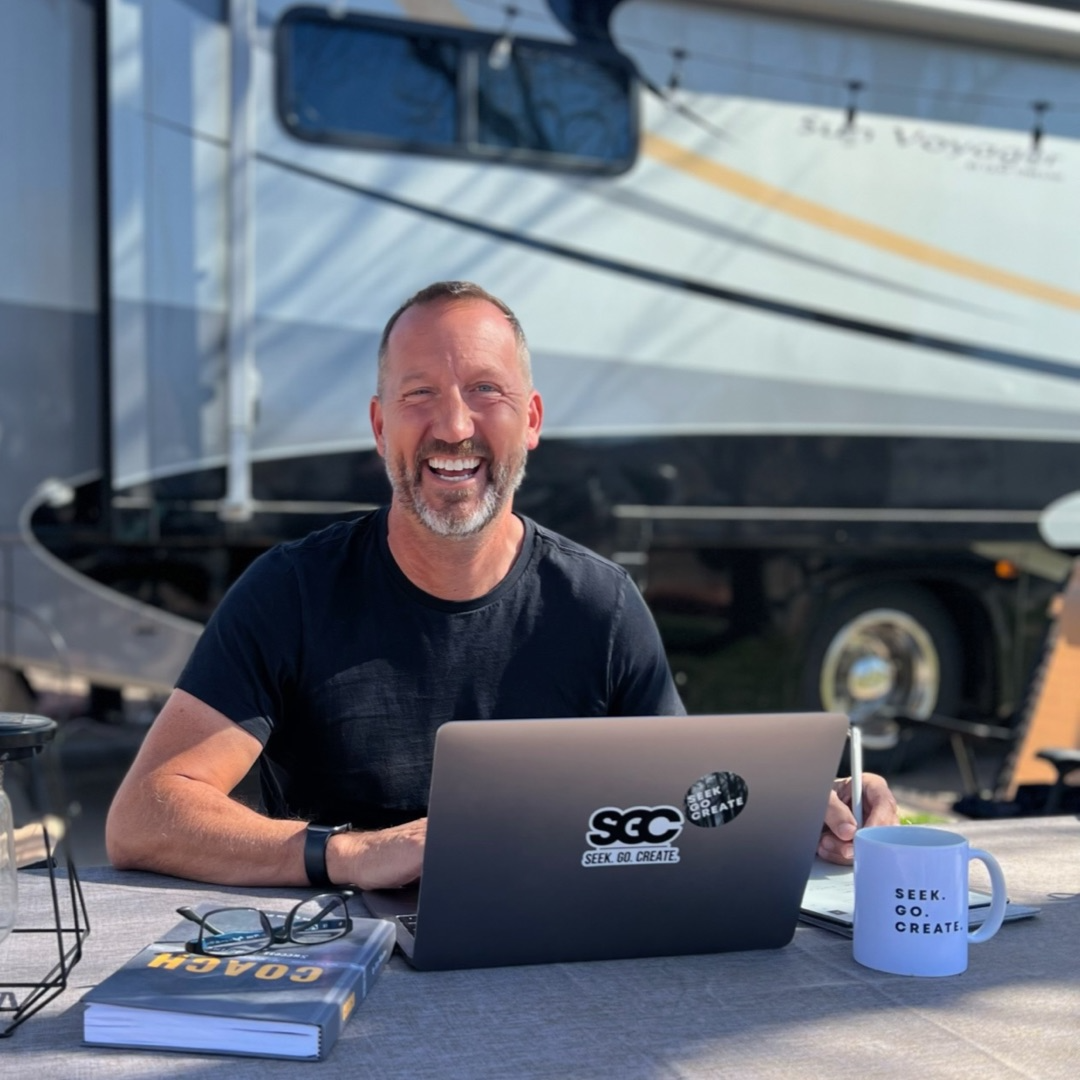

Breaking Free from Wall Street: Joey Muré on Faith, Stewardship, and True Financial Freedom

What if building true wealth had nothing to do with Wall Street or a traditional 401(k)? In this episode of Seek Go Create, host Tim Winders sits down with Joey Muré, co-founder of Wealth Without Wall Street, to challenge the status quo of financial freedom. Joey shares how his background in faith and business shaped his radical approach to money, stewardship, and legacy—plus why cash flow (not simply saving) is the real secret to wealth. If you’ve ever wondered how to take control of your financial future and align your money with your values, this conversation is for you!

"It's not about having more money—it's about seeing money as a tool to be abundant with others, within your family, within your community, within your church." - Joey Muré

Access all show and episode resources HERE

About Our Guest:

Joey Muré is the founder and partner at Wealth Without Wall Street, and a leading voice in helping individuals achieve financial freedom outside of traditional investment systems. With more than a decade of experience in the mortgage industry and a strong commitment to faith-driven leadership, Joey blends financial insights with purposeful guidance to empower others to take control of their wealth. Known for his expertise in passive income and stewardship, Joey has built a community and platform dedicated to challenging the status quo, prioritizing impact, integrity, and generosity in both business and life.

Reasons to Listen:

- Discover Wealth-Building Beyond Wall Street: Joey Muré breaks down why the traditional savings and 401(k) approach actually holds you back from financial freedom and introduces the concept of taking true ownership over your money.

- Faith, Stewardship, and Money Myths Debunked: Hear how Joey’s personal journey—and his experience growing up in a faith-based home—shaped his bold perspective on wealth, generosity, and the misunderstood relationship between faith and finances.

- Real Passive Income Strategies, Unfiltered: Get an inside look at the practical systems Joey uses to generate tens of thousands in monthly passive income—including the pitfalls, the wins, and why authenticity matters more than empty “thought leadership.”

Episode Resources & Action Steps:

Resources Mentioned in This Episode:

- Wealth Without Wall Street Website & Community - Special listener page: wealthwithoutwallstreet.com/seekgocreate - This page offers access to their community, resources, and direct ways to connect.

- Book: "Become Your Own Banker" by Nelson Nash - This foundational book introduced the infinite banking concept and inspired much of the Wealth Without Wall Street approach.

- Wealth Without Wall Street Podcast & YouTube Channel - Regular episodes and interviews on creating financial freedom, passive income, and alternative wealth-building strategies outside of traditional Wall Street approaches.

Action Steps for Listeners:

- Assess Your Financial Goals and Cash Flow - Re-evaluate where your money is going each month and whether your current strategy (e.g., 401(k), savings, IRAs) aligns with your goal of achieving financial freedom, not just retirement.

- Explore Your Investor DNA - Take the Investor DNA Profile at Wealth Without Wall Street to discover which passive income strategy best matches your personality, resources, and lifestyle.

- Start Learning about the Infinite Banking Concept - Read "Become Your Own Banker" by Nelson Nash or listen to Joey and Russ’s episodes about infinite banking to understand how you can put your savings to work more effectively.

Key Lessons:

- Wealth Is Built Through Cash Flow, Not Just Saving: Simply storing money in savings accounts rarely leads to wealth. True financial freedom comes from actively putting your money to work and generating ongoing cash flow.

- Stop Abdicating Responsibility for Your Finances: Many people blindly trust Wall Street or financial professionals without taking personal ownership. Joey emphasizes the importance of stewarding—rather than abdicating—your finances, viewing yourself as an owner instead of a passive participant.

- Faith, Stewardship, and Abundance Are Linked: Joey’s approach weaves together faith, responsible money management, and the idea that abundance is designed not only for personal gain but also for generosity and impact within your family, community, and church.

- Passive Income Requires Active Engagement: There’s no such thing as “easy” or “hands-off” when it comes to building passive income streams. Joey stresses that achieving true passive income starts with intentional learning, due diligence, and disciplined investing—then you reap the rewards.

- Find the Financial Path That Fits You: Not every passive income strategy fits every personality or circumstance. Joey recommends understanding your own “Investor DNA” and aligning your investment and freedom goals with your unique skills, resources, and ambitions for a sustainable wealth-building journey.

Episode Highlights:

00:44 Introduction to Joey Muré and Wealth Without Wall Street

02:06 Joey's Background and Faith Journey

06:29 The Concept of Discipleship and Financial Stewardship

14:39 Transition to Wealth Without Wall Street

25:09 The Infinite Banking Concept

31:56 Debunking 401(k) Myths

32:48 The Importance of Financial Freedom

37:24 Challenges of Passive Income

41:05 The Passive Income Operating System

44:10 Steps to Financial Freedom

52:53 Real-Life Passive Income Examples

58:20 Connecting with Wealth Without Wall Street

Resources for Leaders from Tim Winders & SGC:

🎙 Unlock Leadership Excellence with Tim

- Transform your leadership and align your career with your deepest values. Schedule your Free Discovery Call now to explore how you can reach new heights in personal and professional growth. Limited slots available each month – Book your session today!

📚 Redefine Your Success with "Coach: A Story of Success Redefined"

- Challenge your perceptions and embark on a journey toward true fulfillment. Dive into transformative insights with "Coach: A Story of Success Redefined." This book will help you rethink what success means and how to achieve it on your terms. Don't miss out on this essential read—order your copy today!

Thank you for listening to Seek Go Create!

Our podcast is dedicated to empowering Christian leaders, entrepreneurs, and individuals looking to redefine success in their personal and professional lives. Through in-depth interviews, personal anecdotes, and expert advice, we offer valuable insights and actionable strategies for achieving your goals and living a life of purpose and fulfillment.

If you enjoyed this episode and found it helpful, we encourage you to subscribe to or follow Seek Go Create on your favorite podcast platform, including Apple Podcasts, and Spotify. By subscribing, you'll never miss an episode and can stay up-to-date on the latest insights and strategies for success.

Additionally, please share this episode or what you’ve learned today with your friends, family, and colleagues on your favorite social media platform. By sharing our podcast, you can help us reach more people who are looking to align their faith with their work and lead with purpose.

For more updates and episodes, visit our website or follow us on Facebook, Instagram, LinkedIn, X, TikTok and YouTube. We appreciate your support and look forward to helping you achieve your goals and create a life of purpose and fulfillment.

Now, you can tip us, buy us a coffee, or offer financial support. Contributions start at just $1, and if you leave a comment, you could be featured in a future episode!

Visit our Support page for more details.

Mentioned in this episode:

Achieve Your Vision with Tim Winders' Executive Coaching

Dreaming of a leadership role that not only achieves goals but also truly inspires? Join Tim Winders, your SeekGoCreate host, on a journey to make those dreams a tangible reality. As an expert executive coach, Tim is dedicated to transforming your aspirations into lasting legacies. With a unique blend of faith-driven guidance and real-world experience, he helps align your professional goals with your deepest values for a fulfilling and successful journey. Ready to shape a path that's truly your own? Schedule a free Discovery Coaching Call with Tim now. Dive into a conversation that could turn your vision into reality. Let's embark on this transformative journey together.

Transcript

there's not a good example of somebody that just saves money in a

Speaker:savings vehicle that gets wealthy.

Speaker:At best, they're going to keep up with inflation at worst,

Speaker:like a checking account or, you know, even a savings account.

Speaker:They're losing ground as it relates to inflation.

Speaker:So it's like termites in your money.

Speaker:It's not actually going to help you get to wealth.

Speaker:True wealth is through cash flow.

Speaker:And so I always have to take whatever the savings dollars I have and put it to work.

Speaker:What would your life look like if you stopped trusting Wall Street and started

Speaker:building wealth on your own terms?

Speaker:On today's episode of Seek Go Create the leadership journey.

Speaker:We're joined by Joey Muray, founder and partner at Wealth Without Wall Street.

Speaker:Joey is a faith-driven entrepreneur with a mission to help people gain financial

Speaker:freedom while living with purpose.

Speaker:With a background in mortgages and a passion for relational

Speaker:leadership, Joey brings a powerful blend of impact, integrity, and

Speaker:generosity to everything he does.

Speaker:Get ready for a conversation that challenges the status quo and offers

Speaker:a fresh perspective on leading, giving, and building lasting legacy.

Speaker:Joey, welcome to Seat.

Speaker:Go create.

Speaker:Oh, Tim, so glad to be here with you.

Speaker:This is gonna be an awesome time.

Speaker:that you're here too.

Speaker:I'm always, excited to talk to people that are from the south because

Speaker:we shouldn't need a translator.

Speaker:But you don't have an accent.

Speaker:You're not from there, are you?

Speaker:I am from the south originally, I was actually born in the South, but my

Speaker:parents were both from Buffalo, New York.

Speaker:So I think there's just this kind of tension always in my, my accent.

Speaker:So that's, that's where that comes from.

Speaker:Yeah.

Speaker:you need a nickname like Bubba or something, don't you?

Speaker:Well, it's Italian, so I'm the Italian stallion is my nickname on the podcast.

Speaker:there you go.

Speaker:No Bubba here.

Speaker:Oh, very good.

Speaker:So, first big question then we're gonna dive in.

Speaker:I like to go into the deep end pretty quick, but any.

Speaker:Time I'm interacting with people from Alabama.

Speaker:I've got to ask the question, Alabama or Auburn, do you have

Speaker:a flag for one of those or.

Speaker:When I moved here in high school, I had so many people put me on the spot

Speaker:with this you for Alabama Auburn Boy.

Speaker:And I just, I'm, I'm the kind, like, if you push me too hard, I'm just gonna

Speaker:say neither one, I'm not gonna go free either one of 'em 'cause that's crazy.

Speaker:But this place is the college football hub of the world.

Speaker:I remember years ago I was in a client's office and he was showing

Speaker:me, he worked for one of the big cable companies and they were just getting.

Speaker:Like the college football channel or whatever it was, it was some

Speaker:big deal around college football.

Speaker:And he said, man, I'm just really stressed out right now.

Speaker:I mean, we just got the word that we got, we are, we're

Speaker:getting rights to this channel.

Speaker:And I was like, okay, well why is that such a big deal?

Speaker:he showed me a heat map of the nation and Birmingham, Alabama.

Speaker:Was this just.

Speaker:Hot red center compared to all the other places in the country.

Speaker:And I thought, oh, okay.

Speaker:I get it.

Speaker:That's why people are so crazy here.

Speaker:So anyway,

Speaker:it is pretty, amazing.

Speaker:We, that's not the purpose of our talk here though.

Speaker:That's just other stuff.

Speaker:So, Joey, I'm curious if,

Speaker:if

Speaker:were to ask you, which question would you prefer, this is kinda

Speaker:like my get started question.

Speaker:Would you prefer to ask the question?

Speaker:What, answer the question, what do you do?

Speaker:Or who are you, which would you prefer?

Speaker:And go ahead and start answering

Speaker:You know, what I would say, what do I do is easier because it's

Speaker:simpler to, you know, just in general conversation, what we do.

Speaker:And what I do is, and I'm driven.

Speaker:To impact the world.

Speaker:And I guess this is kind of both, right?

Speaker:It's who am I and what we do.

Speaker:I'm driven to impact the world so much that when I was in the mortgage

Speaker:business, for 11 years, I got compelled by this concept that we now

Speaker:teach at Wealth Without Wall Street.

Speaker:So much so that I was at a conference and I was just like, wow, why do

Speaker:more people not understand this idea of taking and stewarding wealth

Speaker:as, an owner, not as somebody who abdicates that to somebody else?

Speaker:And it was almost, it was one of these rare occasions.

Speaker:I'll go ahead and say that I felt like God put his thumb in my back

Speaker:and said, why don't you do it?

Speaker:And I thought, oh, well, because my wife is pregnant with our fourth

Speaker:daughter, we have five, but at the time was our fourth daughter.

Speaker:She doesn't have a job.

Speaker:I'm the sole provider.

Speaker:I'm making over $300,000 a year.

Speaker:I'm comfortable in the mortgage business.

Speaker:Those are the reasons why I wouldn't risk it all and go, you

Speaker:know, try to teach people this.

Speaker:But man, it was so compelling that I said, people need to know this system.

Speaker:They need to know what the importance is of not abdicating the responsibility for

Speaker:your finances that God's entrusted you.

Speaker:And then how to then turn that into financial freedom.

Speaker:So that's what we do.

Speaker:We're about freedom and it starts with spiritual freedom, but then

Speaker:it leads to financial freedom and all that comes along with that.

Speaker:that, that's good.

Speaker:I mean, anytime people make statements like.

Speaker:I want to impact the world.

Speaker:I have these two things that go through my head, Joey, so I'm gonna share

Speaker:'em and I'm gonna let you respond.

Speaker:First thing is usually a Wow, that's pretty awesome.

Speaker:I want to know more, which is part of my question.

Speaker:And then the second thing that goes through my head is impact the world.

Speaker:You're right.

Speaker:Come on.

Speaker:You know, kind of this, really that's what it is, because I think I've

Speaker:had similar things in, in my head.

Speaker:Has that kind of always been on your mind?

Speaker:I mean, like going back to, you know, kid on the playground or

Speaker:when did that crystallize for you?

Speaker:You know, I would say in college I was very much impacted by a

Speaker:ministry called Campus Outreach.

Speaker:And I'm not certain if everybody's familiar with 'em.

Speaker:They're mostly.

Speaker:in the southeast, on college campuses and mostly smaller

Speaker:campuses, although they're definitely growing into bigger schools now.

Speaker:But there was the concept of discipleship that was taught to me

Speaker:that man, Jesus impacted the world by literally spending time with 12 people.

Speaker:And those 12 people he didn't even spend all of his time with.

Speaker:He really focused on three, but just from those relationships in three years

Speaker:of ministry, there's a reason that you and I are talking about him today, and

Speaker:we're not in Jerusalem, like you're in Arizona and you're all over the country,

Speaker:but I'm in Alabama and I am impacted by what happened over 2000 years ago with

Speaker:Jesus affecting three people or 12 people.

Speaker:How can I impact the world?

Speaker:Well, I can do that here.

Speaker:Wherever I'm at, I can spend time with people and pour into their lives that

Speaker:then they can continue to do that.

Speaker:I now get the opportunity through this media, right, through a podcast, there are

Speaker:people, there are thousands of people that listen to our show all over the world.

Speaker:And so for me, I didn't necessarily know how, but I knew that that was

Speaker:always a drive since I got really impacted with that idea of discipleship.

Speaker:you know, there's some words I'm gonna bring three concepts together

Speaker:and then ask you some questions.

Speaker:I believe that people of faith

Speaker:I.

Speaker:have at times different thoughts about money or wealth and, and

Speaker:sometimes they're not good.

Speaker:And correct and biblical and the right thoughts.

Speaker:So we, we will kind of have that as a foundation.

Speaker:But then I love the word love that your word brought up the word

Speaker:discipleship because I think that that's what we're really lacking a

Speaker:great deal of in the kingdom of God.

Speaker:I think it's really something that we have a lot of people maybe

Speaker:saying things, but not people may spending time and discipling and

Speaker:walking people through things.

Speaker:So, three things.

Speaker:People of faith, the challenges or issues that they have with money,

Speaker:and then kind holding someone's hand and discipling and working with them.

Speaker:I believe that you guys are working on all three of those and, and I think you've

Speaker:got a community, you've got podcast.

Speaker:I think podcast is a good portion of it, but to me, community coaching

Speaker:and different things like that is like one next level thing.

Speaker:So I, I guess I'm just kind of throwing three words at you.

Speaker:Faith.

Speaker:Money or wealth and discipleship, and I'm, discipleship.

Speaker:I'm just gonna let you

Speaker:respond.

Speaker:Sure.

Speaker:Well, I'll just tell you, I'll kind of sum it up in to those three.

Speaker:So one, faith, we don't have any sort of a statement on our website that says you

Speaker:have to be a Christian to engage with us or that we are going to share our

Speaker:faith with you when you engage with us.

Speaker:But I can tell you there's been numerous opportunities.

Speaker:For people to engage with us that maybe would've never stepped foot in

Speaker:a church, that now they're thinking differently and asking questions.

Speaker:And we've even seen some people come to faith.

Speaker:One of the guys that works for me right now became a Christian because he brought

Speaker:up a very simple, question one time.

Speaker:He was sharing his story and telling us about what happened.

Speaker:He said, well, I know you and Russ are religious.

Speaker:And I was like, no, we're not.

Speaker:We're not religious at all.

Speaker:And he said, what, what are you talking about?

Speaker:I said, we have a relationship with Christ, but if you think religion is

Speaker:gonna save anybody, you're sadly mistaken.

Speaker:In fact, I learned these things.

Speaker:I'd love to share 'em with you at some point.

Speaker:And if you wanna do that.

Speaker:So we just engaged in a Bible study He became a Christian through that process.

Speaker:And so, yes, faith is super important.

Speaker:It's not something that we require of anybody to engage with us,

Speaker:but it's super important and it's the foundation for how we think.

Speaker:And I would say that that leads into, stewardship, which is how the church, how

Speaker:the world thinks about money, what drives everything in our mind is stewardship.

Speaker:That you are not the owner of anything, but that God is the owner and he entrusts

Speaker:to you All of life's resources that you've been given, including your time,

Speaker:including your body, including your money, including your relationships,

Speaker:your experiences, all these things are things God's entrusted to you.

Speaker:And we have not only a requirement, but a privilege.

Speaker:To be able to steward those things in a way that reflects God's glory.

Speaker:And the biggest challenge we hear from people of faith, people in the

Speaker:church, outside of the church, is that they have a really bad idea

Speaker:that money is the root of all evil.

Speaker:Money has all these negative connotations.

Speaker:Like, oh, well, even, you know, the rich are, it's impossible for a rich man to

Speaker:enter the, the, the kingdom of heaven like a camel going through the eye of a needle.

Speaker:There's so much context missing from those conversations, but it has

Speaker:embedded in their minds a scarcity and almost like a fear, for money.

Speaker:And so I find that the church is one of the, like most, Atrophied or like

Speaker:really struggling to become abundant.

Speaker:And, and you know, it's not just about having more money that is abundant,

Speaker:it's about seeing money as a tool to be abundant with others within your family,

Speaker:within your community, within your church.

Speaker:And I can dive into more concepts around that if you want, but

Speaker:that to me is like a foundation.

Speaker:And then the last thing on the discipleship aspect, I would say what

Speaker:drives me in what we do is to say, man, there are things that we've learned

Speaker:about money and passive income and financial freedom that I want to model.

Speaker:So there's a reason why Russ and I share our personal passive

Speaker:income report every month.

Speaker:It's not because we're bragging, it's because we want to model what's possible.

Speaker:We show people our actual system that we use to perpetuate passive income.

Speaker:Because it's a model.

Speaker:It's just like Jesus modeled to the disciples how to interact with people,

Speaker:how to, share about the kingdom of God, how to engage with the lost.

Speaker:All those things are models.

Speaker:Well, we do that within our business.

Speaker:We help people, we come alongside in a discipleship type process where we

Speaker:coach people, they set the system up, and then they graduate into, how do I

Speaker:get my first $500 of passive income?

Speaker:Well, there's a 12 week process that they are engaged with.

Speaker:They have to apply and qualify and all that, but they get in and they then

Speaker:have a group that also has an individual coach that's helping them to get there.

Speaker:So it's, it's not perfect and I don't, I never wanna make a claim that.

Speaker:It could be similar to Jesus's process, but it's based off of the principles

Speaker:of what we've seen in that example.

Speaker:Does that make sense?

Speaker:Yeah.

Speaker:Yeah, that, that's really good.

Speaker:And we may circle back, I do wanna look at some practical things in just a few

Speaker:minutes here, but there's something that I, this is just a question that

Speaker:I always have when I'm speaking of

Speaker:speaking

Speaker:someone with, that's in these industries I think, Joe, I'd like

Speaker:to frame it in a couple of ways.

Speaker:Number one, I'm curious about your faith journey growing up.

Speaker:You mentioned in college, you were around, the organization there,

Speaker:but I also would like to know your relationship with money growing up.

Speaker:I think you mentioned you were in the mortgage industry and maybe

Speaker:we can chat about that briefly, but talk about your journey.

Speaker:I mean, did you just kind of come out of the womb saying, yeah, I've got

Speaker:a healthy relationship with money.

Speaker:I don't, I don't think about it too much, but also don't ignore it, or was

Speaker:there a journey involved with that?

Speaker:What can you share

Speaker:I'll say the reason why I'm so, kind of acutely aware of how the church has

Speaker:just brutalized this whole concept is because I was a, I don't wanna say a

Speaker:victim, but I was a result of that.

Speaker:And it was, you know, I remember conversations with my parents.

Speaker:we grew up going to the Salvation Army Church.

Speaker:My parents actually worked for the Salvation Army for 40 years.

Speaker:They just recently retired.

Speaker:They never had money, and they always spoke of it in a negative connotation.

Speaker:Like those with money were not necessarily serious about their faith.

Speaker:those with money were almost like sellouts in a sense because

Speaker:oh, well they're the rich people and this and that and the other.

Speaker:And I never, and so I kind of adopted those same things.

Speaker:Money wasn't something I saw.

Speaker:It wasn't something that I understood.

Speaker:It wasn't something that I really ultimately wanted.

Speaker:I equated somebody who's sold out for Jesus is going into full-time ministry.

Speaker:Somebody who's not, oh well they're in the business world and you know, whatever.

Speaker:That kind of thing had a really, really bad idea of that.

Speaker:And then in college I was, faced with some businessmen that I met that were giving

Speaker:and generous and proactive and very like, responsible and desiring to impact others

Speaker:at a point that I'd never experienced.

Speaker:And they had the means to do things that were required to send people.

Speaker:I started to see God's economy.

Speaker:As not only people who are willing to go, but people who are called

Speaker:to send and that God's economy doesn't work without the other one.

Speaker:Like both of them are required for the kingdom to go forth.

Speaker:And so, I started to pursue going into full-time ministry

Speaker:with that kind of understanding.

Speaker:And God switched paths.

Speaker:I literally was going and starting to raise support to become

Speaker:a college kind of minister.

Speaker:And doors just kept shutting and shutting and shutting.

Speaker:And it was just one of those weird moments where I was like, God, I thought

Speaker:this is what you wanted me to do.

Speaker:And he'd redirected me to the business world with this new kind of, passion to

Speaker:say, I want to try to live so below my means that I can send with a passion.

Speaker:I want people, when they talk to me about raising support.

Speaker:I want to be like, how can I support you?

Speaker:I want to be like, how can I trust the Lord to increase what he's given me so

Speaker:that I can pass it on, not so that I can just keep increasing my lifestyle.

Speaker:I want to keep increasing the capacity to give.

Speaker:And man, that was a drastic change from how I grew up.

Speaker:and again, I think it was just understanding the bible, understanding

Speaker:what Jesus said about money and taking it in context versus the Christianese kind

Speaker:of, cultural like view of these things that were just quite frankly just wrong.

Speaker:Yeah, and I wanna say this, this is not throw our parents under the bus, talk

Speaker:here, but they had scriptures to back up their thought process about money and

Speaker:the context is extremely important to bring into when Jesus is saying things

Speaker:about money and who is he speaking to and what are they doing at that time,

Speaker:that would be a great conversation.

Speaker:Let's don't go there.

Speaker:but, and I'm always fascinated by this.

Speaker:I cannot tell you, Joey, how many people that we've had here at Seek go

Speaker:create that thought full-time ministry.

Speaker:There were people of faith and they felt like they were called, that's

Speaker:another Christianese word if you ask me.

Speaker:They were called to go into the ministry progression, you know, youth

Speaker:pastor, assistant pastor, whatever.

Speaker:And you know, the ultimate, which is a missionary on foreign, you

Speaker:know, foreign soil Somewhere.

Speaker:And then they, and then when they leave that they go through this, oh my gosh.

Speaker:You know, they're getting messages from friends.

Speaker:Oh, you're backsliding is everything okay?

Speaker:but it sounds like that happened with you early on.

Speaker:Did you, were you, did you go into the mortgage world immediately or were

Speaker:there some other stops and starts along

Speaker:the way?

Speaker:Yeah, actually it was, it was just really the lord's kindness.

Speaker:I was meeting with some of those businessmen who I'd gotten connected

Speaker:to, and I was just kind of lost and I was like, man, I really thought for

Speaker:sure I was going into ministry and now I'm trying to pivot and figure

Speaker:out where in the business world I fit.

Speaker:So I met with several of them and just asked them, what do you do?

Speaker:Like, how does, how does it work?

Speaker:I, I just really haven't had experience.

Speaker:And one of those guys was extremely strong believer who owned his own mortgage

Speaker:company, and he was just sitting with me and just telling me what he did.

Speaker:And I thought, man, that sounds really up my alley.

Speaker:Like something I would really enjoy and I'd be gifted at.

Speaker:And he said, you don't have any experience, so you, no, I don't

Speaker:hire people without experience.

Speaker:I'm like, what?

Speaker:I mean, you just sold me on this whole idea.

Speaker:I'm ready to go.

Speaker:He's like, look.

Speaker:Go find anywhere that will hire you, a bank, small bank, and just even

Speaker:if they let you process mortgage loans, just to get your head

Speaker:around how does it work and get the experience, that's your first step.

Speaker:Well, at the time I lived across the street from a bank, little tiny bank, and

Speaker:I said, well, I'm gonna take his advice.

Speaker:I walked across the street with my resume and a plate of cookies and I sat with him.

Speaker:I said, look, I just need to get some experience in the mortgage business.

Speaker:will you, will you hire me?

Speaker:And the lady was so hungry that day, her stomach was growling in the interview.

Speaker:And I was like, look, I, I brought some cookies.

Speaker:You know, they're out there in the lobby, like, help yourself.

Speaker:and they thought that was the funnest thing that anybody ever done.

Speaker:So they hired me.

Speaker:And when I say they hired me, they put me on a hundred percent commission and

Speaker:said, go, go see what you can kill.

Speaker:I made no money for like three months, but I got experience and started

Speaker:to get my hands around it, and then I went back to that original guy

Speaker:and said, Hey, I did what you said.

Speaker:I got experience.

Speaker:Six months in.

Speaker:He was like, okay, you can come work for me now.

Speaker:So you're off to the races now.

Speaker:I think if I did my timeframes right when I was looking at your background,

Speaker:you were in the mortgage industry during that incredible awesome time of 2008.

Speaker:we do not wanna spend much time on that, but just gimme a little bit of

Speaker:what, what, how did Joey do during that?

Speaker:Did the Lord just lift you up and you never had any pain or discomfort?

Speaker:you notice how I was sort of joking about the lift you up, not total rapture,

Speaker:which I'm not a huge proponent of, but just lifted you up so that you didn't

Speaker:have to go through that tribulation and then set you back down gently in

Speaker:around 2011, 12, or was there another

Speaker:story?

Speaker:Well, you know what's super crazy is at the time I was working for

Speaker:Wells Fargo and we serviced, they serviced all of their loans and.

Speaker:You know, 2008 hit and most people see from the real estate person's

Speaker:perspective how bad it was.

Speaker:And if you ask me how many purchase loans I was able to do

Speaker:during that time, it was very few.

Speaker:'cause people weren't going and buying new houses.

Speaker:But what they were doing is the rates went from the sixes down into

Speaker:the fours and all of a sudden I got inundated with refinance loans.

Speaker:People that I had done business with for 5, 6, 7 years at the time.

Speaker:Now they needed to refinance at a much lower rate.

Speaker:And there were some government programs even that were allowing them to do it

Speaker:without, you know, having to show as much income and all this kind of stuff.

Speaker:I actually grew my income in my business during that time because

Speaker:we had so many people looking to take advantage of those lower rates.

Speaker:So.

Speaker:it was actually a blessing and most of my real estate friends struggled, but

Speaker:in terms of the mortgage industry, it was a great, actually time to be in.

Speaker:Interesting.

Speaker:Well, I'm one of those that went from whatever, the palace to

Speaker:homeless at all during that season.

Speaker:So I actually appreciate stories like that because sometimes we lump, every EMS

Speaker:says, oh yeah, it was tough, tough, tough.

Speaker:So

Speaker:So I think that's awesome.

Speaker:so this is my shift into, wealth without Wall Street.

Speaker:I've got 1, 2, 3, 4, maybe five browsers pulled up on my computer here.

Speaker:And obviously you and your partner Russ, y'all have

Speaker:have really

Speaker:leaned into.

Speaker:The wealth without Wall Street, message, because I see podcasts, I see YouTube,

Speaker:I see books and, scan through, listened to, looked at all of those, over the

Speaker:last few days as I've been, you know, researching all things that are.

Speaker:Joey, tell me about, I bet there was a transition as you moved into that.

Speaker:Tell me a little about the transition, and we're gonna be moving into, the

Speaker:last good bit of time we have talking about what's wrong with Wall Street,

Speaker:what do we need to be looking at, passive income, things like that.

Speaker:So start it.

Speaker:Tell me about how it kind of got started.

Speaker:Wealth without Wall

Speaker:Street.

Speaker:well, I'll tell you the baseline of our entire thing and the thing that

Speaker:compelled me, to switch careers from the mortgage industry into what we do

Speaker:now is, there was a book that I read in 2009 that Russ actually shared with me.

Speaker:We were friends from church, that's how we met.

Speaker:And he said, man, I'm gonna start sending you referrals as long as you understand

Speaker:the concepts I'm teaching my clients.

Speaker:It's called Become Your Own Banker by Nelson Nash.

Speaker:And as I read that book, it's only 88 pages.

Speaker:Very small, big print, you know, easy read.

Speaker:I was just shocked that this was the thing I had always like, was looking

Speaker:for, but didn't know what it was.

Speaker:This was the mindset shift that took me from blindly just keeping my head

Speaker:down, working 50, 60 hours a week, putting money away into my 401k.

Speaker:Into IRAs and just hoping for retirement at someday.

Speaker:And what he shared in that book was that I needed to take control of my

Speaker:finances, And actually, Nelson Nashville was a strong believer before he passed.

Speaker:I would say that it was becoming a steward of what God had given me and

Speaker:not abdicating it to somebody else, which is what we've all been duped.

Speaker:I say duped or encouraged or manipulated to think that, man, you know what,

Speaker:Tim, you're just not that smart when it comes to financial matters.

Speaker:And you didn't go to school to become a financial planner or a

Speaker:market analyst or what have you.

Speaker:You just don't have time for that.

Speaker:So you just give me all your money.

Speaker:And I'll be the one to manage it for you.

Speaker:Now, a manager in any other situation actually has ownership or requirement

Speaker:or liability to what they're managing.

Speaker:But in the financial world, wall Street, they have no liability.

Speaker:In fact, your accounts can go up or they can go down and

Speaker:they will get paid regardless.

Speaker:And they will encourage you that, Hey, you know what, we

Speaker:just can't control everything.

Speaker:Like, you know, this is what happened.

Speaker:The market did this, the market did that, and you are literally stuck

Speaker:on a rollercoaster at that point.

Speaker:If the market goes up, you don't wanna sell because what you're gonna miss out,

Speaker:there's this FOMO of it could continue to go, you don't, if it goes down.

Speaker:You don't wanna lock in your losses and sell because now you're so far

Speaker:behind, like what are you gonna do?

Speaker:You've just really lost.

Speaker:So you just continue this up and down, and Wall Street profits with today's dollars

Speaker:on your money every single month where you are putting your money into there

Speaker:with the hope that it's enough when you're 65, 70, whatever the case is, it is the

Speaker:biggest scam that we have been told of all time, and people willingly give that money

Speaker:over to that system every single day.

Speaker:What Wealth without Wall Street is all about was born outta this concept

Speaker:called the infinite banking concept, which takes all of your cash flow,

Speaker:puts it into your control, into your economy, and then it begs you.

Speaker:To become an investor.

Speaker:And that's really where this whole thing came.

Speaker:We didn't know what to invest in.

Speaker:Tim, I'm just being honest with you.

Speaker:If you asked me in 2008, I would've said, go buy like a piece of

Speaker:real estate, a rental property.

Speaker:That's about all I could think of.

Speaker:But we started the podcast in 2017 because we had all these clients

Speaker:doing this infinite banking concept.

Speaker:They had all this cash that they were putting into their system

Speaker:and it's a high cash value life insurance kind of system of policies.

Speaker:And they're sitting there, Hey Joey, Russ, what do we do with it?

Speaker:And we're like, I don't know.

Speaker:What do you think?

Speaker:I mean, so we started interviewing people that are passive income, real

Speaker:estate, online entrepreneurs, people that could know what to do with capital.

Speaker:And it was all off of Wall Street.

Speaker:So thus the name Wealth Without Wall Street controlling your

Speaker:cash and the end result.

Speaker:Being, when your passive income exceeds your monthly expenses, you're now free.

Speaker:I mean, as Tim is shaking, is nodding his head 'cause he

Speaker:knows what we're talking about.

Speaker:But as you listen to us, I want you to think about your calendar right now.

Speaker:You pull up your phone, I got my phone right here.

Speaker:You pull it up, you look at the calendar.

Speaker:The question is, are the things on your calendar dictated

Speaker:by you or by somebody else?

Speaker:Is it your business that is owned you, that you literally have no time

Speaker:to do anything outside of because it's really dictating to you?

Speaker:Or do you work for somebody else in a W2 fashion that your majority of your life is

Speaker:being owned and dictated by somebody else?

Speaker:The financial freedom formula, when your passive income

Speaker:exceeds your monthly expenses.

Speaker:That means money that is at work on your behalf coming in monthly

Speaker:exceeds what it costs you to live.

Speaker:I then get to dictate what goes on the calendar, and that could be

Speaker:exactly what God has created me to be.

Speaker:I don't know what that is for you, but that is the end result that we're

Speaker:trying to accomplish and everything we do is centered around that very concept,

Speaker:I am sure.

Speaker:With a message.

Speaker:Wealth without Wall Street, since Wall Street is the norm or the

Speaker:standard, or the propagandized, way, whatever term we want to use.

Speaker:I think I might've shown my hand there.

Speaker:Darn it.

Speaker:I was trying to ask this in a different way.

Speaker:it's what the masses believe.

Speaker:Now it's interesting the masses don't necessarily participate in

Speaker:it, but they believe the headlines.

Speaker:I can't pull my phone up, it's my camera.

Speaker:But if I go to any financial headline, they will be reporting

Speaker:on, today, you know, recording this sometime in April, something that the

Speaker:current president did that caused.

Speaker:The market to go down 500, up 500, whatever you, but what are, what's

Speaker:some of the pushback or arguments you get from people when you say that you

Speaker:can create wealth without Wall Street?

Speaker:Because

Speaker:there's probably some that are going through a few people's minds listening in.

Speaker:Let's go ahead and hit a few of those.

Speaker:And then I wanna talk about passive income in general before we get to

Speaker:some specifics.

Speaker:Sure.

Speaker:So number one, people are, I'll just use 4 0 1 Ks as an example.

Speaker:They're like, Joey, I mean, I, you're telling me not to put money in 4K.

Speaker:Like, that's dumb.

Speaker:I get free money for my employer.

Speaker:I get a hundred percent match.

Speaker:That's like a, it's free money.

Speaker:It's a hundred percent return.

Speaker:I don't have to pay tax on that money.

Speaker:Right?

Speaker:It's a tax deferred type of opportunity.

Speaker:Why wouldn't I do that?

Speaker:And, and here's the thing that it comes down to,

Speaker:if we're keeping score the same way, if you truly do want financial

Speaker:freedom today, okay, and I'm talking to somebody who's 30 to 50 years old,

Speaker:let's just say that that's the window of time that we're talking about.

Speaker:And you say, I wanna be financially free today or as soon as possible,

Speaker:then by putting money into a 401k, you are actually reducing your ability

Speaker:to become free today because you're, you're purposely and voluntarily.

Speaker:Putting money into something you can't touch until you're 59 and a half.

Speaker:You say, okay, that makes sense.

Speaker:But what about the, the match?

Speaker:Does the match it the matches your incentive, your enticement to put your

Speaker:money away for the next 20 years, 30 years, whatever, however old you are, is

Speaker:that going to keep that, that could be keeping you from what your actual goal is.

Speaker:So if you, now if you are like, you know what Joey, I just

Speaker:want to go towards retirement.

Speaker:I don't want to think about it.

Speaker:I just wanna be on autopilot.

Speaker:This is not your message, right?

Speaker:Because you just keep doing what you're doing.

Speaker:But for the person that says, you know what, he's right.

Speaker:I want to spend time with my family today.

Speaker:I want to be more active in my church family.

Speaker:I want to be more, available because life is owning me.

Speaker:Then the answer is, I have to take back control.

Speaker:I have to be in a position to become an investor, to buy back my

Speaker:time by creating passive income.

Speaker:So people push back on the four one K until we have that conversation.

Speaker:Because if your goal is different than mine, then we don't

Speaker:have anything to talk about.

Speaker:But if we have the same goal, then you have to objectively agree no matter

Speaker:what the internal rate of return is, no matter what the tax benefit today is,

Speaker:by the way, there is no tax benefit.

Speaker:'cause 30 years from now, there's no telling what the taxes are going to be

Speaker:when you actually start to pay them.

Speaker:But if we're talking about financial freedom, there is no denying that that

Speaker:is the worst vehicle to get you there.

Speaker:And so that's one thing.

Speaker:And then I'd say the second thing is people just don't want to be different.

Speaker:They want to be just like everybody else.

Speaker:They want to stay safe, they wanna stay.

Speaker:Comfortable in the herd.

Speaker:And for that person, I can't help 'em either, because you have to

Speaker:be willing to do something that no one else is doing to have the

Speaker:results that no one else is having.

Speaker:And if you're not willing to do that, then you need to just kind of

Speaker:reorient your expectations to not be surprised when you end up exactly in

Speaker:the same place that everybody else is.

Speaker:It's like somebody going to, you know, a really overweight personal trainer.

Speaker:They've already proven that that's the result.

Speaker:Why would I go to them?

Speaker:They don't have the result that I'm looking for.

Speaker:But it's just the same as going and following someone else.

Speaker:Your, your, you know, your peers, your friends, your family who's telling you

Speaker:all these things to do with your money.

Speaker:And you look at their life and you say.

Speaker:Actually, that doesn't really match up for me.

Speaker:I wanna do something different than them.

Speaker:But yet you're doing the same things as them with your money.

Speaker:Those things do not coexist.

Speaker:You cannot do that.

Speaker:You have to have a reality check and say, I need to go find a

Speaker:different personal trainer.

Speaker:I think what you said earlier is pretty powerful.

Speaker:I want to bring that back up again, that we're not abdicating.

Speaker:Someone doing something with our money.

Speaker:They just don't wanna think about it, don't wanna talk about it.

Speaker:They, you know, they don't have the conversations like we're having here.

Speaker:I love talking about money.

Speaker:I love talking about wealth.

Speaker:You know, it's, I've never had an issue with it.

Speaker:in fact, I might.

Speaker:At times should talk about it less.

Speaker:But, anyway, so, so I do think they sort of UI use the word abdicate it.

Speaker:They shun it, they resist it, and I like the word stewardship.

Speaker:We've used the word stewardship here.

Speaker:We're on 300 plus episodes.

Speaker:That word comes up quite a bit

Speaker:And

Speaker:really an understanding of.

Speaker:The gifts, talents, you know, whatever that God has given us, we steward over

Speaker:those and I believe we have to give it back in a better condition than when we

Speaker:received it as part of that stewardship.

Speaker:Now, something that comes up though that is, I think a stumbling block for people

Speaker:is this, this passive income or passive money because we're programmed to go to

Speaker:work, get paid, go to work, get paid.

Speaker:and I actually at times can be cynical about passive income because some

Speaker:of the hardest work I've ever done is in the pursuit of passive income.

Speaker:And, I'll bring this up from the book.

Speaker:I think y'all have something called the PIOS Passive Income Operating

Speaker:System, which to me, operating in passive is a little bit of an oxymoron.

Speaker:So I'm gonna call you out a little bit and make you really talk about it.

Speaker:But anyway, jumbo shrimp, passive operating anyway.

Speaker:But, talk about, people that need to overcome the hurdle of no passive income.

Speaker:You, you can't do that.

Speaker:It's not a real thing.

Speaker:And, you're always gonna have to do work for some type of financial

Speaker:reward.

Speaker:Yeah.

Speaker:Well, so I'll just say, you know, spoiler alert, passive income

Speaker:requires active engagement.

Speaker:In order for it to ever be passive.

Speaker:Okay?

Speaker:So for instance, and this is where I think most people get the bad idea, I can become

Speaker:a poor investor by passively throwing money at things and not ever spending any

Speaker:time in due diligence or understanding what it means to be an investor.

Speaker:You have to put in the time, you have to put in the energy, the effort to be

Speaker:able to know what good looks like, okay?

Speaker:Otherwise, the very first thing that you look at is gonna look

Speaker:fantastic, and it's a dog.

Speaker:I'm just gonna tell you, you haven't looked at 10 deals.

Speaker:You looked at one and one looks amazing.

Speaker:You look at 10, and that one may be the worst of the 10, but the reason that

Speaker:you don't do it is because you didn't get active as becoming an investor.

Speaker:the second thing is whenever you are even looking, let's say you've become

Speaker:an investor and you are knowledgeable and understanding, when you are

Speaker:looking at deals, you have to actively engage in a due diligence process.

Speaker:This is the stewardship aspect.

Speaker:Hey, this pitch deck came by me, my office, and I look at it and

Speaker:it looks good on the surface, but there's some due diligence items.

Speaker:Like who's the operator?

Speaker:What's the asset type?

Speaker:Does it fit my investor?

Speaker:when does the capital actually start to come back to me?

Speaker:Is it quick?

Speaker:Is it three months?

Speaker:Is it six months?

Speaker:Is it 12 months?

Speaker:Is there a stabilization period?

Speaker:Is it geographically located in a place that I want my money to be, stored up in?

Speaker:Is it in like looking at the macroeconomics of the world?

Speaker:Does it look like it's in a place where it's gonna continue

Speaker:to grow or is it shrinking back in terms of the market itself?

Speaker:these are all things that, as an investor, you actively engage with that

Speaker:opportunity before you passively invest.

Speaker:And so to your point, passive income does not mean uninvolved income.

Speaker:You have to be an investor and you have to take the time to not just

Speaker:blindly throw money at something.

Speaker:if you do, you'll become an investor by learning the lessons the hard way.

Speaker:but it is a necessary step to become that.

Speaker:Now to answer your passive income operating system.

Speaker:The operating system is the active flow of cash in your economy, and most people

Speaker:never get out of what you just said.

Speaker:Get paid, pay the bills, get paid, pay the bills, get paid, pay the bills.

Speaker:That's the rat race.

Speaker:That's the rat race that we get stuck in.

Speaker:The Passade operating system connects a whole different side to that.

Speaker:I get paid, I pay the bills, and there's whatever's left over,

Speaker:gets into the right hand side.

Speaker:We call that the wealth, accelerator side.

Speaker:And that's where we tie in the infinite banking concept.

Speaker:That's where we tie in this never ending compounding machine that is

Speaker:passively growing for you, but it is all a part of the active, controlled

Speaker:environment that you put your cash flow through so that it can create the

Speaker:passive income that will then free you.

Speaker:Good.

Speaker:And we've already established earlier that

Speaker:this is not necessarily easy.

Speaker:It's not.

Speaker:I think there's some simplification.

Speaker:We're gonna talk about that here in our last bit of time together.

Speaker:we're gonna simplify what that looks like so someone can understand.

Speaker:there are steps along the way that people have to do a little extra, I think is the

Speaker:way I heard it as we're going through it.

Speaker:I think the first part, you just brought it up actually, you said it at the

Speaker:very beginning, is that you chose to live below your means and have extra.

Speaker:I actually think that a large percentage we could.

Speaker:Probably find the math pretty easily of people.

Speaker:This is a, we go all over, but let's just talk about the us.

Speaker:They are not living below their means.

Speaker:They're not living at their means.

Speaker:They're living above their means, which means this is gonna be a

Speaker:tough conversation for them, right?

Speaker:right.

Speaker:I mean, because this is not some kind of magical, get rich quick, you

Speaker:know, you snap your fingers and all of a sudden you're still gonna have

Speaker:the same cars and the bills and the credit card debt, and this is going

Speaker:to magically get you outta that.

Speaker:That's not the case.

Speaker:I've actually been around a lot of people of faith that have that philosophy too, by

Speaker:the way, um, that God's going to somehow, um, wipe everything out and all that.

Speaker:So let's talk about, let's assume that someone's listening in and they've got

Speaker:some extra, and they're intrigued by this.

Speaker:They've got extra money.

Speaker:Let's say they're in that age bracket that you talked about

Speaker:earlier, and they go, you know what?

Speaker:I'd like to start creating this.

Speaker:You called it a system, I'll call it a bucket, that they wanna start putting

Speaker:something into this bucket I've heard

Speaker:life

Speaker:I've heard contracts with life insurance.

Speaker:I've heard.

Speaker:Then I start investing.

Speaker:Let's take just a few baby steps and walk people through the, the basics there.

Speaker:So

Speaker:sure.

Speaker:How does it get started?

Speaker:So the first thing is the passive income operating system is getting your goals

Speaker:aligned with what you do with cash.

Speaker:If my goals are to become financially free, to get my passive income

Speaker:exceeding my monthly expenses.

Speaker:I'm no longer gonna put money into 4 0 1 Ks than IRAs.

Speaker:I'm gonna stop the flow of money into those vehicles, which means I now have

Speaker:more money in my bank account at the end of the month, assuming I don't

Speaker:allow my lifestyle to creep, right?

Speaker:Number two, I'm gonna stop paying cash for everything that I do.

Speaker:Cash is the most expensive way to pay for anything, and most people will

Speaker:challenge me on this and say, well, Joey, I mean there's no cost to cash wrong.

Speaker:There's opportunity cost that you never get a bill for.

Speaker:What do I mean by that?

Speaker:If I go and put a hundred thousand dollars down on a house that I'm going to then

Speaker:use as a rental property or a second home, or what have you, whatever you wanna call

Speaker:it, that a hundred thousand came from my bank account, which at that point doesn't

Speaker:have any ability to earn another dollar.

Speaker:Until I replace it back, right?

Speaker:Nobody's gonna send you a bill that says, Hey, by the way, Tim, that a

Speaker:hundred thousand could have earned $36,000 over the last eight years

Speaker:or whatever the timeframe was.

Speaker:But that's the reality of what actually happened.

Speaker:Now, why do we then use infinite banking or these, whole life insurance policies

Speaker:designed for cash value because they allow you to not only store the capital, put

Speaker:the money into these contracts, but then to borrow against them so that your money

Speaker:always grows, never stops compounding.

Speaker:So you never give up the opportunity cost, and you can repay it over time.

Speaker:With these, there's loan provisions and things we could probably get into

Speaker:if you want to, but the reason we just replace your checking account

Speaker:with a better mousetrap, something that gives you more of what you want

Speaker:it to do and less of what you don't.

Speaker:And then the third thing that people stop doing when they're really actively

Speaker:trying to get to this place of, building financial freedom is they

Speaker:stop paying off their debts as the only design for what they do with money.

Speaker:I love Dave Ramsey because he helps people who are living way above

Speaker:their means get below their means.

Speaker:He helps them psychologically to say, stop doing stupid things and trying to keep

Speaker:up with people that don't care about you.

Speaker:I'm glad Dave is, but when it comes to absolutely like, you know, the simplicity

Speaker:of his deal is just pay off all debt.

Speaker:All debt is bad, never get debt.

Speaker:It's so bad.

Speaker:Don't ever do it.

Speaker:When you're trying to keep, tabs on this financial freedom formula, you

Speaker:have to be objective about when do you pay off debt and when do you not?

Speaker:It's just not this blanket.

Speaker:Like if it's debt, you pay it off.

Speaker:You say, man, I've accumulated $50,000 and I have two choices to make.

Speaker:I can either, again, 'cause I'm keeping track of the formula, passive

Speaker:income exceeding monthly expenses.

Speaker:There's two sides to the coin, not just monthly expenses,

Speaker:which would include debts.

Speaker:And so I say if I have $50,000 that I've accumulated in my

Speaker:system, what do I do with it?

Speaker:I can either go put it into a passive asset, maybe it's a syndication, maybe

Speaker:it's into a land flipping business, maybe it's into a private loan, whatever.

Speaker:And let's just say that that would create $500 a month.

Speaker:Or I can take 50,000 and I can pay off a car loan.

Speaker:And let's just say that the car loan was $350 a month.

Speaker:If I'm keeping tabs on this formula and I could either produce $500 a

Speaker:month passive income or pay off $350 a month for my car loan, which one

Speaker:is actually getting me closer to my goal to produce the 500 a month?

Speaker:Right?

Speaker:So although I could have paid off the car, it actually would've taken me

Speaker:backwards on my ultimate goal of passive income greater than monthly expenses.

Speaker:Notice that I did not say what the interest rate was

Speaker:because it doesn't matter.

Speaker:It's about the cash flow, which one is getting me closer to financial freedom.

Speaker:And so if you can be objective about that and keep that as your main focus.

Speaker:Now you have a system that you are consistently using those

Speaker:dollars at the highest level to get you to your end result.

Speaker:So that's kind of how the first step that people have to do is stop doing

Speaker:certain things with money, start doing things with money that really uplift

Speaker:and encourage your actual end goal.

Speaker:And we can talk about steps two and three, but that's, that's

Speaker:the number one thing in my mind.

Speaker:Yeah.

Speaker:And the big thing here is, if you're coming against Dave Ramsey, you may

Speaker:have some issues you have to deal with because we won't say he's the 13th

Speaker:disciple, but some people think he is.

Speaker:And,

Speaker:and,

Speaker:and,

Speaker:and I've known people that have come against Dave and it's like, Ooh.

Speaker:And I pull for Dave and I agree in general with the debt thing also.

Speaker:but there, there is ways of leveraging.

Speaker:so you've got this system that I still think some people have a

Speaker:difficult

Speaker:wrapping their head around.

Speaker:So I'm gonna get whole life policies, I've got contracts, and then from

Speaker:those policies I'll borrow against the cash value so that I could

Speaker:then go out and do other things.

Speaker:I'm sure there's some people will say, you know, I think I'm gonna

Speaker:just get the policies and let it sit.

Speaker:That.

Speaker:That.

Speaker:That is probably fine, but it's not really maximizing what someone can

Speaker:do.

Speaker:Correct.

Speaker:Well, think about it this way.

Speaker:the policy is not an investment.

Speaker:The policy is a replacement for your savings vehicle.

Speaker:So you tell me, if someone says, yeah, I'm just gonna let the policy ride and

Speaker:that's gonna be my, you know, long-term deal, well then the question would

Speaker:be is how, how wealthy do you believe people that just save money become?

Speaker:There's not, there's not a good example of somebody that just saves money in

Speaker:a savings vehicle that gets wealthy.

Speaker:At best, they're going to keep up with inflation at worst,

Speaker:like a checking account or, you know, even a savings account.

Speaker:They're losing ground as it relates to inflation.

Speaker:So it's like termites in your money.

Speaker:It's not actually going to help you get to wealth.

Speaker:True wealth is through cash flow.

Speaker:And so I always have to take whatever the savings dollars I have and put it to work.

Speaker:Otherwise, I use the term it's lazy cash.

Speaker:Lazy cash is not acceptable.

Speaker:We have to keep it at work.

Speaker:It has to be doing work while we're actively at work or creating

Speaker:wealth, it has to be doing its job.

Speaker:the policies just are the greatest holding place.

Speaker:Nelson Nash called it Your Warehouse for wealth.

Speaker:And I think that's a perfect analogy because what's a warehouse?

Speaker:Do money come, things come into the warehouse, things go out of the warehouse.

Speaker:Things come into the warehouse, things go out.

Speaker:your policy or your system of policies has to be always in flux, always being used.

Speaker:It's not something to just be sitting there, you know, picking up dust.

Speaker:and so that's one thing we've really, really honed in on is the systematic

Speaker:use, not just the, you know, the cul-de-sac, if you will, for your money.

Speaker:Right, and that's where a lot of these, which I love these topics.

Speaker:I mean, you guys have massive amounts of topics on your YouTube channel

Speaker:and your podcast where you're really just gathering, it sounds like you're

Speaker:gathering information to try to find ways of generating passive income because

Speaker:you've got all of these mechanisms, these savings mechanisms in place that

Speaker:people can then go out and do that.

Speaker:There's one interesting thing that you do, and I think I heard it on the

Speaker:podcast, I guess you probably do it on YouTube too, is that you and Russ will

Speaker:state where you are currently at your key performance indicator of passive.

Speaker:Income.

Speaker:I want to ask you if you can say where that is here in spring.

Speaker:We'll put a timestamp on this episode, spring of 2025.

Speaker:But before I do, I wanna ask, if your parents are okay with you letting the

Speaker:world know with the background you grew up in letting the world know how much money

Speaker:you're making in your passive income.

Speaker:Did they ever say anything to you

Speaker:about that?

Speaker:I'm curious.

Speaker:You know what it is, it is somewhat of a concern that people are like,

Speaker:wait a minute, you're putting this out on, front street here.

Speaker:And my, answer to that, Tim, is we don't want to be thought leaders.

Speaker:I think the world is hungry for authenticity.

Speaker:Like they need to know.

Speaker:I. That you're not just talking about something, that you're actually doing it.

Speaker:That there is actual action being taken and that people

Speaker:are eating their own cooking.

Speaker:You know, that's how we say it here in Alabama, right?

Speaker:Eat your own cooking.

Speaker:We, we want people to, we need to be results leaders, and it is

Speaker:uncomfortable at times, but what we always lead with is this is not

Speaker:a boastful like, Hey, look at us.

Speaker:This is, Hey, this is what's working.

Speaker:This is what's not working.

Speaker:By the way, we share those arrows in the back as well, and we've had some

Speaker:pretty humbling moments on the podcast and on the YouTube channel, but at the

Speaker:end of the day, it's to lead by example.

Speaker:I, I told you that initially Jesus gave models.

Speaker:This is a model that we can share with the world to say, we built the system.

Speaker:We became investors, not perfect investors.

Speaker:In fact, we've lost a lot of money and this is the result.

Speaker:And if you want results similar, we can show you the way that's, that's

Speaker:ultimately what this is about.

Speaker:we don't share our active income.

Speaker:We share our passive income.

Speaker:And, our whole job is to inspire, educate, empower, and expose

Speaker:people to what's possible.

Speaker:Yeah, I think I heard ranges 30 5K to 50 and bouncing around

Speaker:right is, I mean, those are

Speaker:nice numbers.

Speaker:Yeah.

Speaker:It does not, it's not perfectly stable every single month because

Speaker:certain things pay out in some months.

Speaker:Certain pay don't pay out in others.

Speaker:I mean, we have, lots of different areas that we ra, you know, have money in.

Speaker:I'll give you one quick example.

Speaker:We have have three cars on Touro that someone else operates, and last month

Speaker:I showed a negative $900 because one of those cars came back with massive damage.

Speaker:Two, two tires busted, or not busted, but the, the, the wheels were,

Speaker:dented and a tire run in was busted.

Speaker:It was just, they must have hit a curb or something and just didn't care, you

Speaker:know, and there was also an alternator that went out, like there's maintenance

Speaker:issues that go wrong, whereas the month before it was like $2,700 just with those

Speaker:three cars and I didn't do anything.

Speaker:It was, I was not hands on at all.

Speaker:So there's ups and downs with each one of these things.

Speaker:But on the whole, they average around 50,000 a month.

Speaker:And, we're constantly just trying to think about what's the next thing or

Speaker:what should we put more money into?

Speaker:And, I think one of our biggest negatives is that we are the ones

Speaker:that interview all these people.

Speaker:And so we wanna try 'em all, you know, like we probably should

Speaker:start to limit down our favorites.

Speaker:what?

Speaker:What's your

Speaker:my favorite,

Speaker:Yeah, I was gonna say, What's your favorite one right now?

Speaker:Yeah.

Speaker:I think buying and selling raw Land on notes is my favorite.

Speaker:if you haven't interviewed the land geek.com, mark Podolski, he taught

Speaker:us this method and he actually has a team that runs our business.

Speaker:We buy land for 20 to 30 cents on the dollar.

Speaker:We sell it to retail buyers on terms.

Speaker:So I buy a property for 2,500, I sell it for 10,000, but the 10,000

Speaker:may be a thousand dollars down and $300 a month for 30 months.

Speaker:That's a perfect deal for us.

Speaker:we just keep stacking 300, 300, 300, and that has, yielded over 30,000 a

Speaker:month just in that one asset type.

Speaker:I love it.

Speaker:it's hard for that thing to go wrong because in any economy, people

Speaker:are flooding to real assets like land and we make it affordable

Speaker:for people to be able to do it.

Speaker:they're not making any more of it.

Speaker:So it's really a great, stable asset class.

Speaker:and it's fully run by an operator.

Speaker:Who's an expert.

Speaker:Yeah, that's good.

Speaker:There's probably so many more.

Speaker:I recommend people, I think I see a bunch of 'em here over on the YouTube

Speaker:channel and I'm sure the podcast.

Speaker:So there's a lot of resources you guys have.

Speaker:I think, Joey, this would be a great time to just share with the audience.

Speaker:We'll include things down in the notes.

Speaker:What's the best way for people to get in touch with you to get more info?

Speaker:You know, you've got podcasts, you've got book, you've got

Speaker:YouTube, where do you want

Speaker:people to go to connect?

Speaker:Well, I'll tell you, we made a specific page just for your audience.

Speaker:if you go to wealth wall street.com, slash seek, go create.

Speaker:So wealth wall streete.com/seek go create.

Speaker:our contact info's on there, our access to our community.

Speaker:I think we have some other free resources there.

Speaker:Love for you to connect with us and let us know that you heard Tim and

Speaker:I, having this, great conversation today so we know where you came from.

Speaker:All right, last quick question.

Speaker:One, quick tip.

Speaker:We've covered a bunch, but like your quick rapid fire tip that

Speaker:you could give before I wrap up

Speaker:The one thing we didn't talk about is becoming an investor.

Speaker:it starts with knowing your investor, DNA, go and find your investor DNA profile.

Speaker:We have a tool that you can engage with us on, and it tells you how does your

Speaker:personality, how did God create you, to see the world with your resources, your

Speaker:experiences, your access to capital.

Speaker:What out of about 16 different passive income strategies

Speaker:line up the best with you?

Speaker:Because you should just be doing the things that have the highest ROI.

Speaker:Do what?

Speaker:Lines up with your personality and you'll actually get, closer and faster

Speaker:to financial freedom than anything else.

Speaker:Excellent.

Speaker:Yeah, I love that because everybody's got different mindset and I mean, there are

Speaker:things that I'm comfortable with that you may not be and et cetera, so I love that.

Speaker:So we'll make sure to include all that.

Speaker:Joey Muray, thank you so much.

Speaker:Wealth without Wall Street is all of their resources.

Speaker:He gave a great link.

Speaker:We'll include it down in the notes it's been a cool conversation.

Speaker:I love it.

Speaker:We've got new episodes every Monday.

Speaker:I appreciate everybody joining in here.

Speaker:Keep commenting, keep rating, all those cool things.

Speaker:I greatly appreciate it.

Speaker:thanks for joining us.

Speaker:See you next week.